Nature offers alternatives to oil

One of the first alternatives to petroleum were biofuels, derived from the fermentation of sugars naturally present in plants such as corn, sugar beet and sugar cane. Plants have the ability to capture carbon dioxide and water directly from the atmosphere and transform them into sugars such as glucose, sucrose and cellulose, which we can then process through chemical processes into fuels such as ethanol. Ethanol (also known as ethyl alcohol and bioethanol) has many advantages over fossil fuels, for example, it is a better anti-knock agent than lead derivatives in traditional combustion engines, and it also produces almost no by-products when burned, other than CO₂ and water, which reduces its impact on the atmosphere and the environment. Two main types of bioethanol are currently used, known as "first" and "second" generation. First-generation bioethanol is produced from food crops such as corn. Although relatively simple and economically viable to produce, it raises concerns about competition with food production and crop sustainability. By using large areas of land, tons of fertiliser and a great deal of energy to harvest, process and ferment the maize, the overall emissions count ends up being much more negative than using fossil fuels. In terms of competition, first-generation bioethanol production is also problematic: in the US, 45% of corn is used to produce fuel, rather than to feed animals and, above all, people (who end up consuming only 5% of the corn grown).

The second-generation bioethanol alternative is somewhat more interesting, as it only uses non-food feedstocks such as agricultural residues, forestry residues and crops dedicated exclusively to energy production. The problem with second-generation bioethanol lies in the technology to convert these materials, usually composed of lignin and cellulose rather than simple sugars, into fuels. These reactions require complex chemical, thermal and enzymatic processes before the products can be fermented to produce alcohol. However, these products are much more interesting from a circular economy point of view, because they revalue waste products. Market projections estimate a growth of 26% per year for this type of fuel to reach a market share of $315 billion by 2030. In Spain, companies such as Cepsa are already exploring this technology which, combined with other products such as biodiesel, is compatible with most combustion engines used in agriculture and transport.

Biodiesel, which also falls into the category of biofuels, is a product derived from vegetable oils, animal fats and other recycled oils through a process called transesterification. During this process, fatty compounds, such as triglycerides, present in oils and fats react with alcohols to produce esters, the fuel compounds of biodiesel, and glycerin as a by-product. Biodiesel has many advantages in the context of the energy transition, especially compared to bioethanol. On the one hand, production from recycled oils and animal fats contributes to the circular economy and reduces dependence on competing crops for food production. In addition, biodiesel can be used in many existing diesel engines without significant modifications, facilitating its adoption in the transport sector. Supportive government policies, such as tax incentives and mandates for blending with traditional, petroleum-derived diesel, are already driving its economic viability in regions of Europe and South America. Furthermore, research into new feedstocks, such as algae, which can be grown exclusively to produce biodiesel without compromising animal and human food, could further improve the sustainability and efficiency of this biofuel as a tool to diversify our energy sources.

By mimicking the process of plants, humans can carry out so-called artificial photosynthesis which, like natural photosynthesis, uses CO₂, water and energy to produce molecules that store energy and therefore have a high added value. In this process, photoactive materials are used to absorb sunlight and use its energy to break bonds in water and carbon dioxide molecules, which can then be recombined into compounds such as hydrocarbons and alcohols, which can be used as fuels. There are currently several working prototypes on laboratory scales that demonstrate the feasibility of this technology, with efficiencies higher than natural photosynthesis, which would provide a very attractive alternative to traditional biofuels in terms of cost-effectiveness. One of the main advantages of these systems is that they are virtually carbon neutral, since the carbon released into the atmosphere when the synthetic fuels are burned is exactly the same as that used in their preparation. The problems with this technology are mainly related to production and scale-up costs. Among other things, the materials and catalysts used in artificial photosynthesis must be stable in the long term under the demanding operating conditions, which means offering high resistance to degradation while maintaining their catalytic activity. Today, researchers are still searching for the best ways for these processes (and synthetic fuels) to compete with fossil fuels. This requires advances in materials synthesis, production scale-up and process optimisation, as well as major investment in exploring new catalysts that do not rely on scarce and conflict minerals to ensure energy independence and security.

From the concept of artificial photosynthesis derives also a number of more cross-cutting technologies, popularly known as "Power-to-X", based on converting electricity, ideally from renewable sources, into sustainable fuels and value-added chemicals. This conversion not only enables the efficient storage and transport of renewable energy, but also offers viable solutions for decarbonising sectors that are difficult to electrify, such as heavy transport, aviation and the chemical industry. One of the most promising approaches in this category is Power-to-Gas (PtG) technology, which converts electricity into gases for combustion.

Another more sustainable option is the production of green hydrogen through the electrolysis of water. The hydrogen produced can be used directly as a fuel, but can also be chemically recombined with captured carbon dioxide (CO2) to produce methane (CH4). This synthetic methane, identical to natural gas, can be injected into existing gas infrastructure, providing a flexible and sustainable solution for energy storage. Furthermore, if the CO2 comes from carbon capture technologies (either direct air capture or capture of combustion products in chemical plants), methane from PtG could be considered climate neutral, as the carbon would be part of a closed cycle.

Hydrogen can also be used to produce other products for the energy store, as well as attractive products for the chemical industry, such as methanol, ammonia and even complex hydrocarbons, as in another interesting alternative within Power-to-X technologies is Power-to-Liquid (PtL). PtL can convert energy from renewable electricity into liquid fuels, such as gasoline and paraffin, by means of a chemical process known as Fischer-Tropsch, which allows the transformation of hydrogen and carbon monoxide (a mixture known as syngas) in hydrocarbons. The synthetic fuels produced are compatible with existing transport and storage infrastructure, facilitating their adoption in the transport and aviation sectors without the need for significant modifications to engines or distribution infrastructure.

One of the key advantages of Power-to-X technologies is their ability to utilise excess electricity from renewable sources, such as solar and wind, which often produce more energy than can be consumed in real time. This problem, popularly known as "intermittency", could be solved if, during periods when there is excess power (either due to lower demand or extraordinary production), the surplus can be converted into liquid fuels. This is a different form of energy storage than batteries, but an attractive one, given that the infrastructure to harness liquid fuels is already developed. Furthermore, Power-to-X technologies can be considered sustainable, as they use only renewable electricity to produce hydrogen and reduce CO2. When CO2 comes from the different capture technologies, its closed cycle contrasts with fossil fuels, whose major drawback is the release of carbon that has been geologically stored for years, contributing to the global increase in atmospheric concentration of greenhouse gases. According to the World Economic Forum, Power-to-X technologies are key to the green transition and achieving climate neutrality by 2050. It is a fundamental innovation to transform sunlight into fuels for our cars and aircraft.

The versatility of Power-to-X technologies is also manifested in their ability to produce a variety of chemicals and materials in addition to fuels. For example, the hydrogen produced can be used in the production of methanol, a basic component in the chemical industry, used in the manufacture of plastics, adhesives and other products. Despite their many benefits, Power-to-X technologies still face a number of challenges, including the high cost of production. Currently, producing green hydrogen, synthetic methane and liquid fuels from renewable energy is still more expensive than extracting and processing fossil fuels. Reducing these costs requires technological breakthroughs, economies of scale and supportive policies that encourage both research and development and the prioritisation of sustainable solutions, through subsidies and support for adoption and competitiveness.

Some forecasts are very optimistic: in Denmark, for example, experts estimate that synthetic fuels and Power-to-X could supply enough energy to cover all national transport by 2025. But global implementation is likely to take much longer. There is still a need to improve the stability, durability and efficiency of the materials and catalysts used in these processes and to develop an adequate infrastructure, which involves the construction of electrolysis plants, CO2 capture facilities and distribution networks for hydrogen and other synthetic fuels.

The development of the sustainable fuels industry offers many benefits, both economically and socially. In economic terms, investment in sustainable fuel technologies can generate a considerable number of jobs in emerging sectors such as research and development, engineering, construction and infrastructure maintenance. It can also stimulate economic growth by fostering innovation and competitiveness. Of course, the benefits of sustainable fuels are equally significant for society at large. Reducing air pollution has a direct impact on public health, as exposure to air pollutants is associated with respiratory and cardiovascular diseases. In addition, sustainable fuels should mitigate the effects of climate change, with profound improvements for social welfare. Extreme weather events, exacerbated by climate change, cause economic losses, population displacement and risks to food security and access to water. Sustainable fuels could help protect the most vulnerable communities, while reducing extractivism and improving ecosystem stability. In short, the ecological and economic transition to circular and climate-neutral production could become an achievable and sensible goal thanks to new sustainable fuels.

The new 'wells' for clean energy extraction

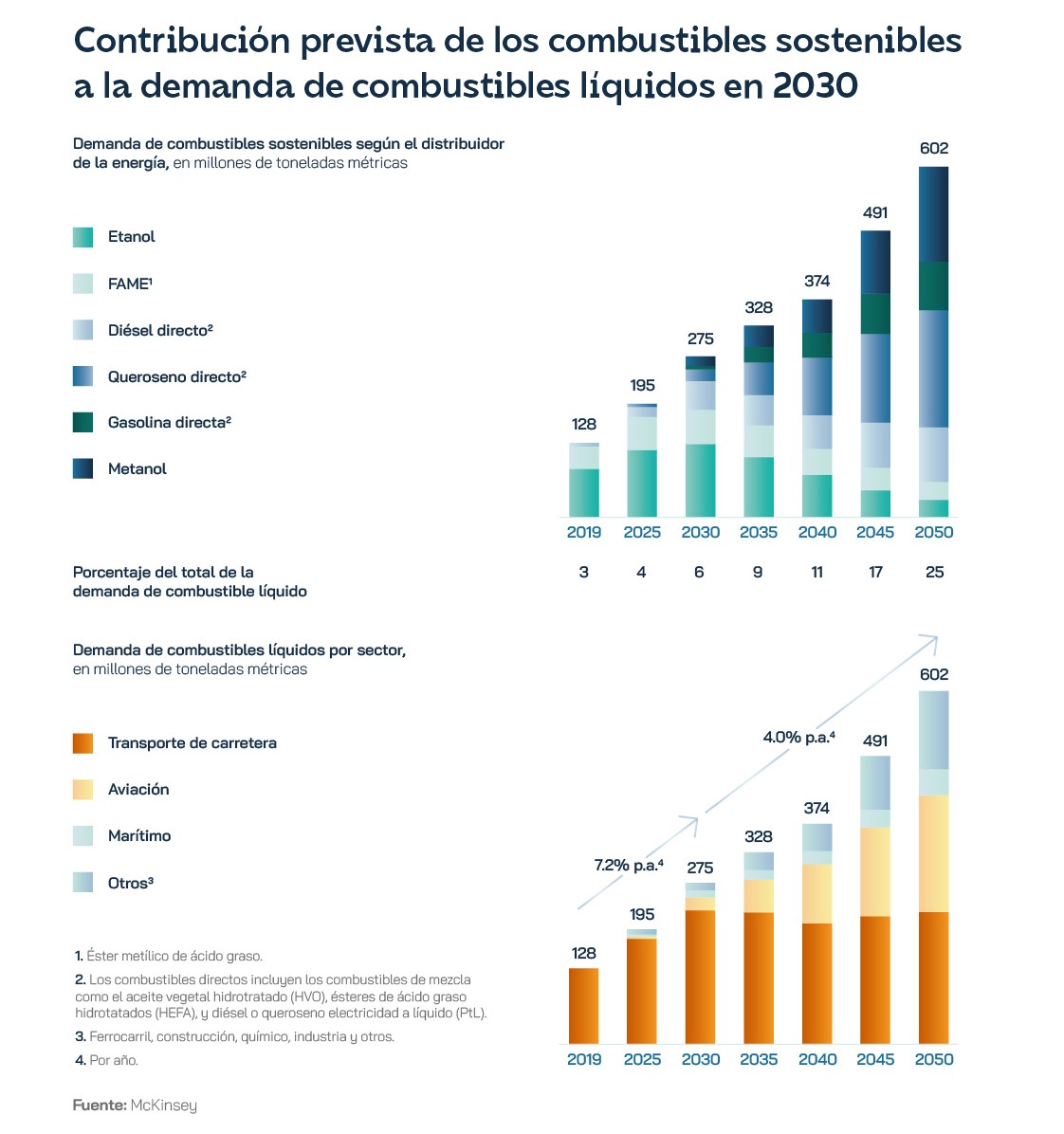

As the world rediscovers the potential of biofuels generated from waste as an alternative to electric mobility and fossil fuels, to which conflicts such as those in Ukraine and the Middle East have given a sensitive geostrategic burden, it is also becoming aware of the technological, demand and regulatory trade-offs that still need to be articulated to turn them into a real possibility on a large scale. By 2024, the International Energy Agency estimated that there would be a 11% (18 billion litres) increase in new demand, although new policies in advanced markets were still unlikely to have an immediate impact due to high biofuel production prices, feedstock issues and technical constraints. During the 2030s, technological advances could stimulate the growth of new avenues for producing advanced biofuels and e-fuels. In this regard, the announced investment portfolio to increase sustainable fuel capacity is in the region of $100 billion. By product, biodiesel and ethanol will be particularly driven; by geography, almost two thirds of this demand growth will be in emerging economies, mainly India, Brazil and Indonesia. These countries have launched policy measures to take advantage of their advantageous position, which allows them to overcome barriers in terms of both feedstock access and costs and gives them the opportunity to reduce dependence on oil producers and, in the case of South America, on gasoline and diesel refineries.

Taking a long-term view, growth in demand for sustainable fuels in the 2040s is expected to be associated with the need to decarbonise existing fleets, so while roads will drive adoption in the near term, aviation and marine fuels will do so thereafter. HVO will capture the bulk of these investments from 2030 onwards, once blending and feedstock limits are reached. This could be between $0.6 trillion and $1.9 trillion by 2050, half of it coming from the EU, US and Canada. Renewable diesel producers will need to be flexible in the face of expected demand for large-scale aviation PBS from 2030 onwards. And new pathways such as methanol, GT-gasification and PtL, if technologically consolidated, could account for around one-fifth of the announced global sustainable fuel production capacity by 2030. In 2050, global demand for sustainable fuels is expected to range from 190 to 600 million tonnes per year, depending on the ambition of the measures taken. At present, conventional biofuels, such as ethanol and FAME (fatty acid methyl ester), make up the bulk of supply, but their weight is expected to decrease by 30% to 60% by 2021 and to be diverted to other uses: ethanol, for example, can be converted into replacement paraffin.

The biodiesel sector contributed to a total US economic impact of $23.2 billion, 75,200 jobs and $3.6 billion in wages. The country has spread its strategic actions to boost biofuels through various regulations such as the Inflation Reduction Act itself, which includes $370 billion in tax credits for the renewable energy industry; the Bioenergy Technologies Office's Waste-to-Energy 2024 Technical Assistance programme and the National Renewable Energy Laboratory; and the Renewable Fuels Standard. The latter has been criticised by the biofuels industry, which accused it, in a letter to President Joe Biden, of lacking ambition. Between January and April 2023, the biodiesel and renewable diesel generated in the country was 30% higher than the cumulative amount generated during the same period of the previous year, tripled the Environmental Protection Agency's (EPA) projections for the whole year and covered the target until 2025. Private investments worth $5 billion have been committed in 10 US states to expand or build 20 oilseed processing facilities by the middle of the current decade.

Producers point to demand as the main alibi and point to data that makes renewable fuels an even more realistic option for combating climate change than electric vehicle technology. According to a study by the American Transportation Research Institute, a transition to battery electric vehicles for long-distance transport in the US will cost more than $1 trillion in electricity infrastructure and vehicle purchase costs over 15 years. Switching to renewable diesel would achieve similar CO2 benefits for an investment five times less, at 203 billion dollars. The reasons for such a substantial gap are that renewable diesel distribution is considerably more scalable than electric vehicle charging and that it can be deployed immediately on trucks with little modification, so it will be more credible for mobilising R&D. In the battle for the narrative about clean fuel sources of the future, the powerful issue of quality of life has also entered the fray. Switching to 100% biodiesel in the transport and domestic heating sectors would prevent 340 premature deaths per year and 46,000 sick days. In the transport sector alone, the risk of cancer would decrease by 45% if heavy trucks used B100 and there would be 203,000 fewer asthma attacks.

The Renewable Energy Directive (RED II)[xi] The EU's target for the consumption of renewable energy sources in 2030 is 32%, for which fuel suppliers must be able to supply a minimum of 14% of the energy consumed in road and rail transport in 2030 as renewable. However, even the European Court of Auditors has warned how different the tasks of planning, regulating and implementing are in the EU. There has been no specific strategy for biofuels since 2006 and it has never been updated, which has created a sense of instability in the market that is not conducive to investment and transformation of potential consuming sectors. Recently, EU regulation has introduced policies to discourage waste to landfill, which will help the industry to grow. But one major challenge remains the parity of ethanol, biodiesel and renewable diesel prices with those of petrol and diesel. The other is to reduce its dependence on foreign dependence, because more than 40% of the biodiesel consumed in the EU or the raw materials to produce it were imported in 2022. China's policy of subsidising biodiesel exports, denounced by the European Biodiesel Board and investigated by the European Commission, could be taking advantage of this immaturity of the market to grab as much space as possible at high speed.

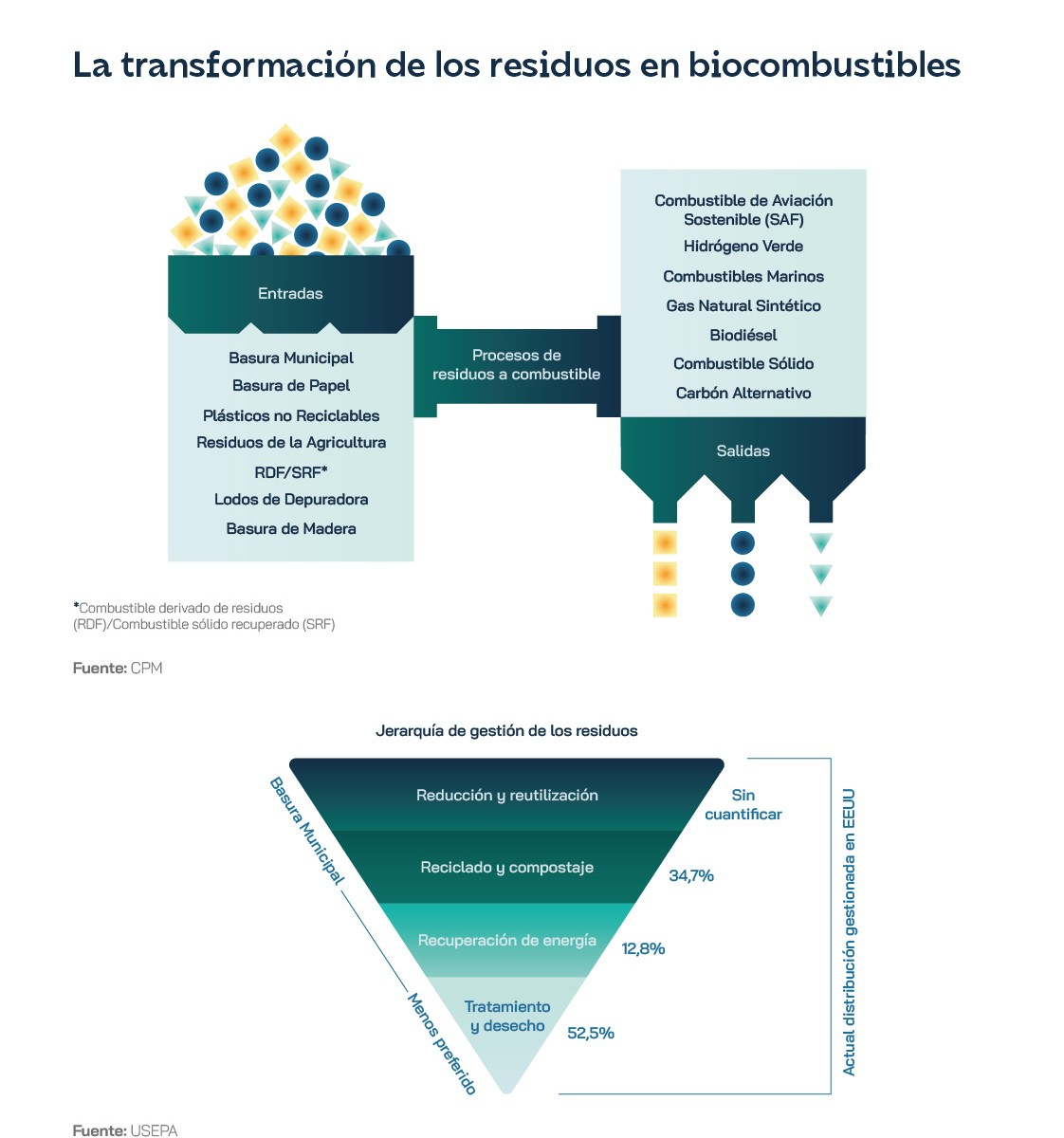

The European Parliament has passed the Net Zero Industry Act (NZIA), which recognises and strengthens the role of waste-to-energy towards a greener Europe. But, according to the EU waste hierarchy principle, reuse and recovery of materials takes precedence over Waste to Energy (WTE). The challenge is to ensure that waste that is not economically or technically recyclable does not end up in landfills and that the energy sector provides a safe sink for the toxic substances that regulators are so concerned about. After all, the world now has more municipal solid waste than at any time in history. The US and Europe alone generate 300 million tonnes per year respectively, which are managed in three ways: recycling and composting (34.7%), conversion to energy (12.8%) and treatment and disposal, mainly in landfills (52.5%). With 76 WTE facilities in the US, 410 in Europe and many more in operation or planned in Asia, the technology is gaining traction because of its significantly smaller carbon footprint than landfills and the additional benefit of destroying contaminated materials containing pathogens and viruses. One of the consequences of its slow implementation is, in fact, the continuing increase in landfill volumes and methane.

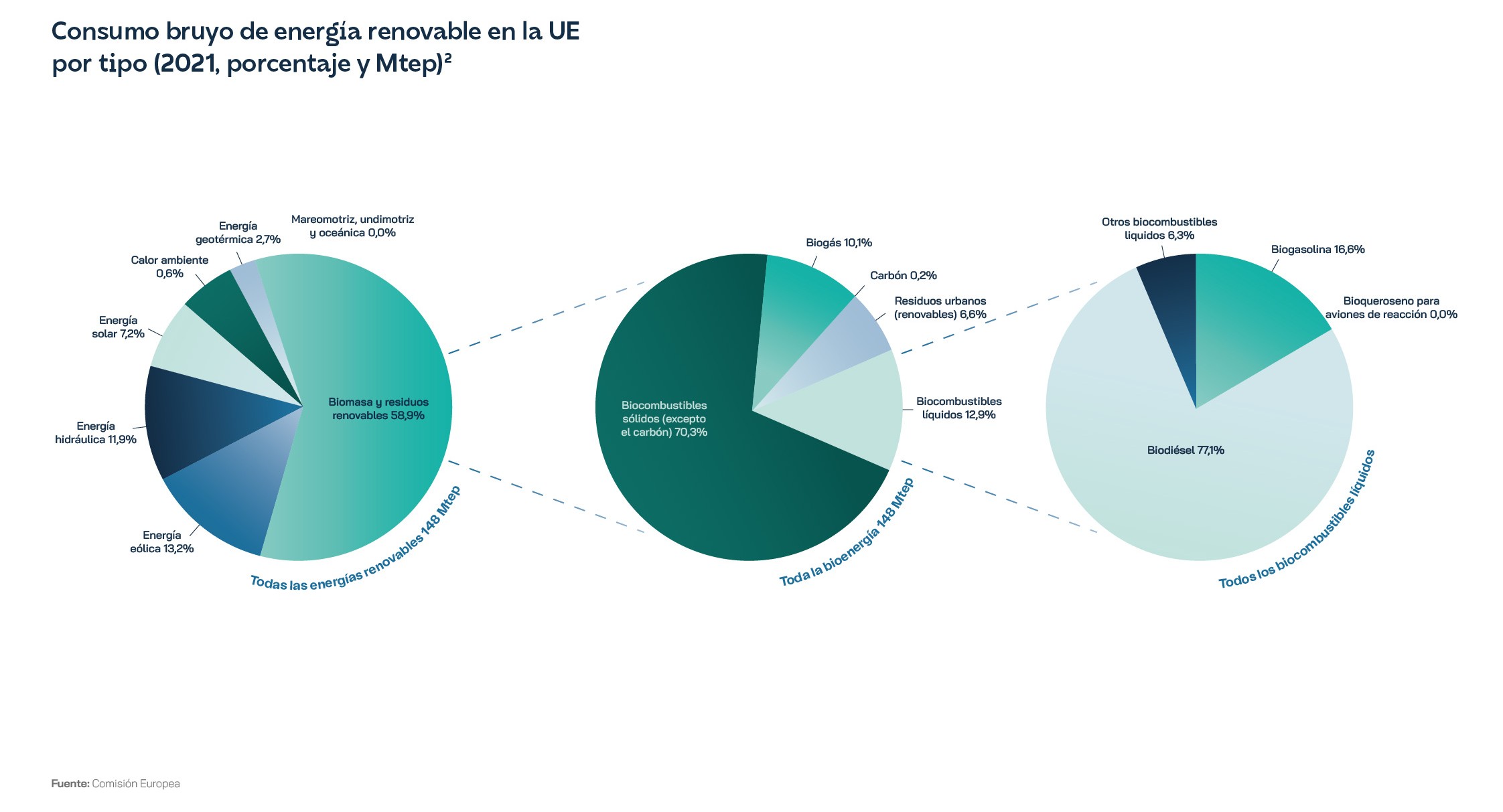

In addition, the European Parliament has set sustainable fuel blending targets, especially for aviation. For bioenergy to advance, according to the IEA, the key is to encourage greater use of waste and residues as fuels, with Latin America, China and the ASEAN countries in the spotlight. It proposes risk mitigation measures such as loan guarantees for pre-commercial conversion technology and biofuel quotas for emerging fuels. The size of the market will also determine the speed at which the waste-based fuel alternative develops. Bioenergy produced from agricultural, forestry and organic waste feedstocks remains the main source of renewable energy in the EU, accounting for 59%, and liquid biofuels account for only 12.9% of the total, an indication of the difficulties the sector still faces.

The UK has analysed its current situation in depth and the data show the vulnerability of advanced economies on this issue. 6.8% of total mobile machinery fuel in the UK was renewable in 2023, with an average greenhouse gas (GHG) saving of 82%, compared to fossil fuels. However, only 11% of all verified renewable fuel supplied in the UK in this period was produced from UK-sourced feedstock. Significantly, 75% of biodiesel was produced from used cooking oil (UCO), which already accounts for 42% of the total renewable fuel if HVO (hydrogen treated vegetable oil) and aviation PBS are also included, while 49% of bioethanol was produced from corn. The share of residual feedstocks for renewable fuels has steadily increased over time and stood at 66% in 2022 in the UK market. China is positioned as a major supplier, especially of UCO, while the US has a dominant position in corn for bioethanol, with cane sugar from Brazil in second position. Organic municipal solid waste is the key source for development diesel, but in the UK 87% of this is also supplied by the USA, as well as 81% of those for development petrol, combined with 16% from Polish and Swedish end-of-life tyres.

Feedstocks are indeed one of the foreseeable bottlenecks for renewable fuels, accounting for between 60% and 80% of the production cost. Waste management frameworks, such as the EU Directive, the UK Waste Management Plan and the Norwegian White Paper on the Circular Economy, admit that circular waste management systems are not yet mature. Europe burns 130,000 barrels of used cooking oil a day, eight times more than it collects, and the US, which tripled its imports in 2023, consumes 40,000 barrels a day. Transport & Environment predicts that by 2030 global sustainable aviation fuel production targets will require at least twice the amount of UCO that the US, Europe and China combined can collect today, not counting that needed to make other fuels, especially renewable diesel. Ryanair alone would need all of Europe's UCO to operate 12.5% of its flights on renewable fuel as it intends to do from 2030. And this is where the shadow of suspicion appears again, because collecting UCO in China is almost 30% cheaper than in Europe, another of the issues that Brussels is investigating for possible unfair practices.

The scarcity of feedstocks could lead to the adoption of more expensive production pathways, such as the use of lignocellulosic plants. At the same time, biofuel generation could become more regional, which could lead to a mix of global commercialisation and local fragmentation, opening up opportunities for a variety of feedstock, technology and fuel mixes. Regulatory changes, such as the expiry of IRA credits and a variation of targets set by the US Environmental Protection Agency and the European Commission, could accentuate this trend. Innovation appears to be the most viable way to propose alternatives to the market. The European SmartCHP project modified a diesel engine so that it could run on biofuel supplied from a fast pyrolysis facility that converted organic waste, such as olive seeds from Greece, forest residues from Sweden and agricultural waste from Croatia, into bio-oil. The biofuel CHP plant was operated in a laboratory for 500 hours, the first time this had ever been achieved. In the WaveFuels innovation project, Organic Fuel Technology and other partners have designed a new microwave process that can convert sewage sludge and other organic materials into biochar and new climate-neutral fuels such as bio-oil and biochar. While in traditional pyrolysis organic matter is heated to between 400 and 600 degrees Celsius, its development operates at lower temperatures of 325-350 degrees Celsius. The pilot plant is located in the circular GreenLab industrial park in Skive and is supported by the Danish Energy Technology Demonstration and Development Programme and Energy Cluster Denmark. Organic Fuel Technology expects to have built 30 WaveFuels plants in Europe by 2035 and to sell 500 systems worldwide by 2050. The Tokyo Metropolitan Government has carried out a feasibility study in 2024 to produce sustainable SAF aviation fuel from municipal waste in the city. Finally, the waste-to-methane project in Dietikon (Switzerland) produces synthetic gas for heating, cooking and refuelling vehicles with compressed natural gas (CNG) engines, significantly reducing CO2 emissions.

Ultimately, pyrolysis, the main technology for converting waste into fuel, presents itself as an alternative to the challenge of CO2 emissions, especially when it comes to waste plastics. The most pressing problem is not plastic as a material, but its entire life cycle, and the OECD expects global plastic use to triple by 2060 to 1.231 billion tonnes. Pyrolysis of mixed plastic waste emits 50% less CO2 than incineration and the resulting product can be refined into diesel and other petrochemical materials. Selectivity can be controlled by the addition of catalysts such as silica-alumina and proton exchange zeolites. However, most of the heavy-duty vehicle decarbonisation in the US has relied on biomass-based diesel fuels, which are fully compatible with the existing refined fuel infrastructure. Its production in the US exceeded 12.4 billion litres in 2023 and achieves GHG emission reductions relative to diesel fuel of between 39% and 92%. Interestingly, the overall impact of biomass-based diesel on short- and medium-term No. 2 diesel prices over the past decade varied from year to year, but ranged from a decrease of 8% to almost 19%.

The era of large production plants

The big energy corporations linked to biofuels have been making moves in recent years with ambitious investment announcements. Cepsa will build a new second-generation biofuels plant in Palos de la Frontera (Huelva), with an investment of up to 1 billion euros. It will produce both renewable diesel and sustainable aviation fuel (SAF) from organic waste, such as used cooking oils and agricultural waste, among others. For its part, Repsol has started large-scale production of renewable fuels at its Cartagena plant, the first in the country, in spring 2024. The aim is to produce 250,000 tonnes of fuel for transport per year, to improve its distribution it will have to increase the number of supply points, which at the end of 2023 were just 50 among its 3,300 service stations. Repsol has acquired the 40% from three biofuel plants of the Bunge group in Spain and has also been building a network of alliances with companies in the field of mobility such as Iberia, Navantia, Alsa, Uber, Talgo and Grupo Sesé to develop a multi-energy response that combines renewable fuels, hydrogen and electrification. Together with Alsa, a leader in road passenger transport, they launched a pioneering experience in the use of HVO in 12 buses of Bilbobus, Bilbao's urban bus service. Iberia made its first three long-haul flights between Madrid and Washington, San Francisco and Dallas, using advanced biofuels produced from organic waste at the Petronor refinery. In 2024, both companies planned to start trials with synthetic fuel produced at Repsol's Bilbao plant. Other initiatives to generate biodiesel in Spain include BioVigo Energy's plant in A Coruña, which will use waste vegetable cooking oils and animal fats.

The regulatory context still causes problems in our country to strengthen the demand for biofuels. In mid-2023, the lack of regulations to govern the entry into force of the environmental sustainability regulation Fuel Quality Directive (FQD) made it impossible to establish, among other things, which biofuel blends are permitted in order to comply with the obligation to reduce GHG emissions by 6% during the life cycle of fuels, as set out in Royal Decree Law 6/2022. As a result, the National Association of Biodiesel Producers from Waste (Ewaba Spain) even considered a stoppage of activity.

On the R&D side, the only Horizon 2020 project coordinated by a Spanish entity was FReSME, led by I-Deals Innovation & Technology Venturing Services, which addressed marine biofuels in a technological dialogue between the steel and naval sectors. On the other hand, due to the high complexity and costs of the process, less than 0.1% of biomass is used to produce biodiesel. In this sense, the EU-funded CONVERGE project team, in which the Spanish company Campa Iberia participates, has validated an innovative value chain for the production of green biodiesel. The 4REFINERY team, in which Repsol participated, demonstrated that it is possible to produce advanced biofuels in existing refineries without the need to build new units. In the Horizon Europe programme, the HYIELD Consortium, which includes Barcelona-based WtEnergy Advanced Solutions, H2Site, Veolia, Enagás, Eurecat, Cetaqua, Inveniam Group, CISC and La Farga, plans to unleash the potential of the waste generated in Europe to produce more than 30 million tonnes of green hydrogen for various industrial applications, such as clean fuels, fertiliser production and the steel industry, among others.