From exploration to space entrepreneurship

The systems commonly known as "shuttles" have been our ticket to hundreds of space journeys, which have taken humans to the Moon, to the creation of space stations such as the MIR and the International Space Station, and have propelled spacecraft such as Voyager to the far reaches of the solar system. Already at the end of the 19th century, the Russian writer and professor Konstantin Tsiolkovsky imagined - a few years after the voyage to the Moon described by Jules Verne, which used a cannon - the possibility of travelling into space using a rocket. However, the origins of space shuttles date back to the Cold War, when missile developments succeeded in creating rockets so powerful that they were capable of launching objects and satellites into orbit. In 1957, Russian researchers and engineers succeeded in launching Sputnik 1, the first artificial satellite, ahead of the Americans, thanks to an R-7 Semeyorka rocket. The American response was to launch the Apollo programme because, in the words of the famous President John F. Kennedy, "they chose to go to the moon before the end of the decade [1960s]". The Apollo rockets, known as Saturn, effectively got man to the moon, thanks to an impressive payload capacity and extremely high reliability that set a new standard for launching heavy payloads into space. Perhaps the most interesting development between the Apollo programme and today, with rockets from companies such as SpaceX, is the Space Shuttle, a NASA vehicle that offered a new, reusable and cheaper way to access space.

Over the course of thirty years, the Space Shuttles carried out a wide variety of missions, including the deployment of satellites, the launch and successive repairs of the Hubble Space Telescope and, perhaps most impressively, the construction and maintenance of the International Space Station. However, the programme also faced a number of challenges, including two tragic accidents that resulted in the loss of the Challenger and Columbia spacecraft, which killed all crew members. According to some space engineering experts, the shuttles were built badly and, moreover, at the wrong time; it was a programme that was "destined to fail". When, in the early 2010s, Space Shuttle Atlantis embarked on its final voyages, new ideas began to emerge to transform the space shuttle industry. One of the big promises was to "revolutionise access to space" by developing new reusable space shuttles. One of the leading companies in this field is SpaceX, founded by billionaire Elon Musk in 2002. SpaceX pioneered the Falcon 9 rocket, designed from the outset to be reusable, which has demonstrated the feasibility and effectiveness of this technology by making numerous successful landings of the various fragments - technically known as 'stages' - of the rocket, something that could significantly reduce the costs of accessing space. This approach not only reduces costs, but has also improved the sustainability of space travel. By recovering and recycling the first stages of its rockets, SpaceX - and other like-minded companies - are paving the way for a future in which sending crew and materials into space is more affordable and sustainable than ever before.

Companies such as SpaceX and Blue Origin, as well as public institutions such as NASA and ESA, have begun research and testing of new, more efficient space shuttles, re-exploring recoverable systems that ultimately provide a more sustainable solution. Reusable space shuttles, such as SpaceX's Falcon 9 and Blue Origin's New Shepard, offer several significant advantages over traditional technologies used by NASA, ESA and other special agencies. Fundamentally, these technologies allow for the recovery and reuse of major components once the payload has been launched into space. This reusability drastically reduces the cost of space travel, as it eliminates the need to build new rockets and new fuel tanks for each mission. In addition, this reduces the amount of space debris, since normally rocket stages that leave for space are simply "dropped" from the rest of the infrastructure and venture into the atmosphere in free fall, or are suspended in orbit. The reuse of launcher systems also contributes to increasing the sustainability of space travel, recycling components avoids the overexploitation of limited resources and the greenhouse gas emissions associated with the manufacture of rockets and other systems.

In this regard, SpaceX has been working on space shuttle cost reduction and rocket reusability for more than two decades. Despite its many successes, including the launch and subsequent recovery of the Falcon 9 rocket, the company has had some very bad times, including several failed launch attempts in 2006 and 2008 that nearly bankrupted it. More recently, its Starship rockets - designed to carry humans into space, with long-term goals such as missions to the moon and Mars - suffered several explosions in the prototyping phases, although they managed to land safely on the fifth attempt. This shuttle system could reduce the cost of getting astronauts into space by up to 100 times, according to Elon Musk himself. These rockets are designed so that some of their stages can return to Earth and land after launch, thanks to small thrusters and several control fins that allow a controlled return to a platform that can be either at sea or on land. Cost estimates calculate that launching - and re-launching - a Falcon 9 is up to 30% cheaper than an equivalent expendable rocket. In addition to Falcon 9 and Starship, SpaceX also markets the Falcon Heavy rocket, purpose-built for heavy payloads and the most powerful rocket currently available, capable of carrying up to 64 tonnes of material to earth orbit. In the absence of shuttles, several space agencies including NASA use Musk-designed rockets to send their astronauts into space and to supply the International Space Station.

Trailing Elon Musk are other billionaires such as Jeff Bezos, the founder of Amazon, and Richard Branson, the founder of Virgin Group. Bezos founded Blue Origin, a space company that is developing a rocket called New Shepard, designed to carry passengers on suborbital flights. Like the Falcon 9, this system is designed to be reusable, thanks to the ability to make controlled vertical landings after launch. However, this rocket barely reaches 100 kilometres above the surface, a long way from the Space Station (located at an altitude of 400 kilometres) and therefore with limited power for longer space flights. The New Shepard passenger capsule is designed for space tourism, currently only available to a privileged few with tickets costing up to $28 million, and is designed with large windows that provide a breathtaking view of the Earth from space. Blue Origin has already sent some twenty missions into suborbital space, but not without problems: in 2022 the US Aviation Administration banned the company's flights for fifteen months after detecting an engine failure in one of the vehicles. In addition to space tourism, Blue Origin is also working on the development of larger launch systems, such as the New Glenn rocket, which, like the Falcon Heavy, will be able to propel cargo to Earth orbit and the International Space Station. Virgin Galactic, founded by Branson in 2004, is developing another alternative for space tourism, the VSS Unity spacecraft. Although not designed to carry cargo to orbit, it represents an important step in the commercialisation of space travel, with prices far more competitive than Bezos' alternatives.

In contrast on a smaller scale are the efforts of the New Zealand company Rocket Lab, founded in 2006. Considered the smallest space launch company, the company's main goal is to offer small and medium-sized launches quickly and efficiently. The company has implemented innovations such as mass production of rockets and, like SpaceX, manages to recover the first stage of its rockets using a system composed of a series of parachutes and the help of a helicopter. In addition to launching commercial payloads of up to 300 kilograms, Rocket Lab has contributed to space exploration by launching scientific and research missions, launching satellites for NASA, ESA and other space agencies, as well as for universities and companies around the world. They are a major competitor in launching objects into low orbits, including the development of mega-constellations of satellites such as Starlink. In recent years, the Chinese Space Agency has developed the Long March launchers, a family of rockets ranging from light to heavy launchers, used for a wide range of missions, including the launch of satellites, spacecraft and astronauts. On the other hand, the Indian space programme has succeeded in developing several launchers that, among other things, have enabled them to send probes that have reached the Moon and Mars. In fact, the Indians are the first to have succeeded in detecting water on the lunar surface.

The implementation and development of reusable launch vehicles is having a transformational impact on the space industry. By reducing the cost of transporting cargo into space, these technologies are opening up new opportunities for satellite launches, science missions and space travel. Several academic analyses focusing on eco-design suggest that, despite the pollution generated by launches and the carbon emissions associated with burning fossil fuels, these devices have a lower long-term environmental impact than traditional alternatives based on single-use rockets. From an economic point of view, they are also - logically - more efficient: reusable launchers allow not only a large part of the rockets to be reused, but also more frequent and efficient launches. At the same time, the development of new launch systems - reusable or not - presents a number of challenges in the medium and long term. First, the design of launchers, especially reusable launchers, requires a high level of technological complexity, which increases costs in research and development and then in manufacturing.

At the moment, public agencies, including NASA and ESA, are at a huge disadvantage compared to the companies of billionaires Musk, Bezos and Branson, who have impressive investments and decades of development ahead of them. It would be interesting to rethink the distribution of public funds in order to be able to first collaborate and then compete with all these companies and avoid leaving the transport of both astronauts and goods in the hands of exclusively private entities. In this sense, both the European Commission and the UK Space Agency have promised large investments for the development of proprietary launch technologies, which can follow in the wake not only of SpaceX's rockets but also of the Ariane systems, a rocket programme coordinated between Airbus and ESA created in 1973. In addition, the recovery of reusable launchers requires complex and specialised logistics, which can be a major challenge for both public agencies and private companies. Finally, space and aerospace regulations would have to be adapted to these new reusable systems, which may create some bureaucratic and ultimately operational hurdles. New legal and regulatory frameworks are required to ensure safe operations, environmental protection and responsible allocation of airspace. In any case, as technology advances and matures - and as new rockets and new solutions appear on the market to cut costs even further - we can expect a significant increase in space activity in the coming years.

In the long term, reusable shuttles could accelerate the conquest of space, starting with the new lunar landings planned in the coming years by NASA and the Chinese Space Agency - both institutions hope to be able to set foot on the Moon before 2030. They are also essential for maintaining and supplying the International Space Station and similar future structures and stations, such as China's Tiangong station. Further down the road, shuttles are sure to play a crucial role in the first manned trips to Mars and beyond, not only for transporting astronauts but also for sending cargo to other planets. We are one step closer to becoming an interplanetary civilisation, one of the most recurring dreams of what was hitherto considered science. fiction.

3, 2, 1... towards a new value chain from start-up

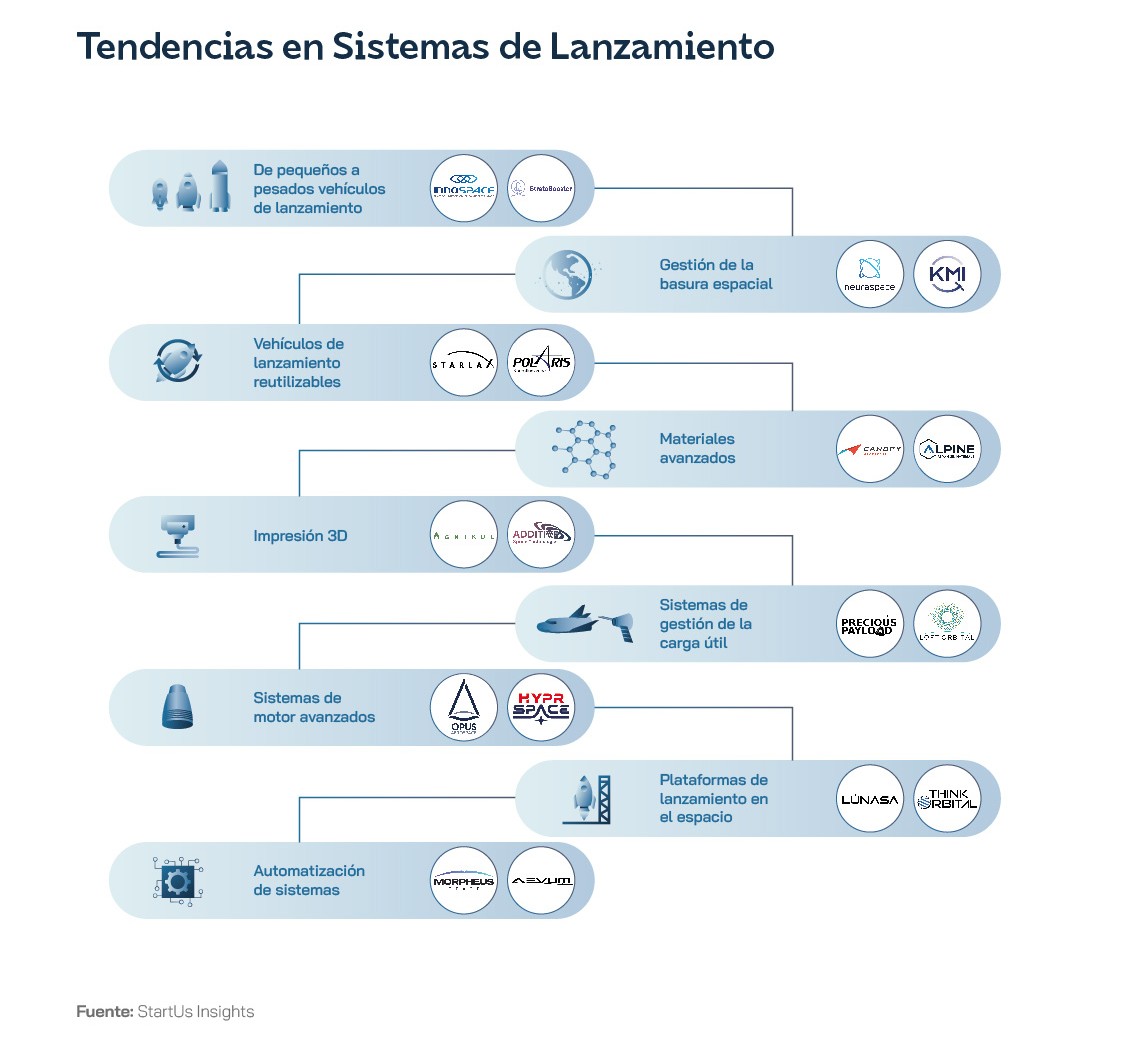

58% of the approximately $240 billion invested in early-stage space companies over the past 14 years has gone to the launch phase, although it represents only 1.5% of the industry's revenues. But the innovation race to build the new space economy has been largely determined there. Many new companies have been focusing on developing launch vehicles that provide novelty in payload size, sustainability or adaptation to different orbital requirements. This last area includes the innovations of South Korean startup Innospace, which is designing a three-stage small satellite launcher that carries a 500 kg payload into a 500 km heliosynchronous orbit (SSO), and UK-based Stratobooster, whose balloon lifts rockets to an altitude of 32 km, where the amount of thrust required is reduced.

One of the key lines of innovation is reusable launch vehicles, designed to recover the primary propellants after mission completion. This can create new revenue-generating opportunities, such as selling or leasing used rockets, or offering discounts and incentives to customers who choose reusable rockets. According to a report by Bryce Space and Technology, reusable rockets could reduce the cost of launch by up to 40% by 2030, making space more accessible and affordable to a wider range of customers. As an alternative to reusability proposed by startups such as Germany's POLARIS Raumflugzeuge and India's Starlax Aerospace, the University of Glasgow has successfully tested a self-powered rocket that uses its own airframe as fuel, something that has been on the minds of engineers since 1938. The melted plastic is directed into the engine's combustion system, effectively producing additional fuel to supplement its liquid propellant. Many innovation efforts are also directed precisely at finding the right mix of solid and liquid fuels and green fuels. France's HyPrSpace engines use a solid fuel fed by liquid oxidant.

The digital revolution is another major vector for the transformation of launch systems, with initiatives in the field of spaceflight systems automation and the integration of artificial intelligence (AI). US startup Morpheus Space's autopilot is integrated into propulsion systems and completely eliminates the need for satellite operators to use custom hardware and software for orbital manoeuvres. Aevum has designed a network of AI-based spaceports that serve as payload delivery and operations facilities, and Beyond Gravity has worked with RevoAI on an ESA project to evaluate the use of artificial intelligence in the development of future structures. In the field of materials, the aim is to produce lighter, stronger and cheaper space vehicles. This includes Canopy Aerospace's heat shields, which protect spacecraft during re-entry and contain multimodal sensors to detect anomalies at any stage of flight. Work is also being carried out on the design and organisation of the payload carried by the spacecraft, which often come in different shapes and sizes. Arianespace has a high compatibility for its rocket. Ariane 5which can launch two payloads simultaneously, using an adapter system that ensures separation without interference or damage.

The development of smaller rockets allows faster and more personalised access to space, opening up the market to a wider range of suppliers. The EU-funded RRTB project, led by Spain's Pangea, hopes to have an engine ready to fly by 2025, demonstrating that small rockets that can carry up to 500 kilograms of cargo can be cost-effective. The technological difficulty lies in the impact of re-entering the Earth's atmosphere on the way back before landing safely. As part of the PRIME project, also financed by European funds, Orbex has unveiled a 19-metre-long prototype rocket, Europe's first fully orbital micro-launcher for small satellites. It is designed to reduce carbon emissions by up to 96% and weighs 30% less than traditional launchers. Supporting this trend are technological developments aimed at creating small satellites, cubeSats and nanosats, which can already perform a variety of functions, such as communications, remote sensing and scientific research, at a fraction of the cost of traditional satellites. The 2,860 SmallSats, from 267 different operators, accounted for about 97% of the spacecraft launched in 2023 and 63% of the cargo, but only 5% were carried on small or micro vehicles, down two points from the previous year.

The confluence of technologies at the forefront of the digital age has been immediate in the field of space launchers. The rocket Relativity Space Terran 1 The Relativity Space payload is the first to be manufactured entirely from 3D printed parts, an innovative copper-chromium-niobium alloy capable of withstanding temperatures approaching 3315°C, up to 40% higher than traditional copper alloys, leading to higher performance and reusable components. As all these innovations reduce the cost of launching payloads into space, the barrier to entry for new customers is lowered, which feeds back into the development of the industry and is leading to more frequent and flexible flight options. Euroconsult estimated in December 2023 the global launch market at $12.6 billion out of a total space economy turnover of $462 billion.

Paradigm shift may come with the rocket project Starship SpaceX's fully reusable super-heavy launch vehicle that will be able to carry up to 150 tonnes of payload to low Earth orbit and then on to the Moon and Mars. If a Starship three times a week, it would be able to put more mass into orbit in a year than humanity has ever sent into space. China, which has set an ambitious agenda to become the world's leading space power by 2045, will also need to be watched closely. To this end, it plans to master independent innovation and is promoting the transfer of defence technology from the military to the commercial sector (and vice versa). The Long March 9 (CZ-9) project envisages the creation of a Chinese super-heavy rocket that will be operational in 2030 and capable of lifting 140 tonnes of cargo to LEO, coinciding with NASA's Space Launch System. These moves lead to talk of a shift from an era of massive restriction to an era of massive abundance. At one extreme, giant rockets capable of driving economies of scale to unknown limits; at the other, proposals such as Virgin Galactic with LauncherOnean air-launched rocket that can deploy small satellites from a modified Boeing 747 aircraft.

Challenges remain, however, which may condition the pace of development of the space launch industry. The regulatory framework and governance are still evolving and uncertain; the environmental impact and sustainability of space operations, especially the debris problem, could push countries to take restrictive measures; and thirdly, space assets and activities are vulnerable to natural hazards, such as solar flares and micrometeoroids, as well as human threats, such as cyber-attacks, jamming and anti-satellite weapons. Some experts expect that there will be between 60,000 and 100,000 satellites in orbit by 2030. In terms of global competition, Europe's launch position could be more ambitious. Of the 221 orbital flights in 2023, only three were by European entities, a far cry from the 114 by the United States, 67 by China and 19 by Russia, or even 7 by India. A very significant percentage of all launches were carried out by commercial spacecraft (116), as opposed to those operated by governments (84) or commissioned by governments to companies (21). In the framework of its revised space policy, which emphasises the need for research and development of next generation rockets following the introduction of the new H3, the Japan Aerospace Exploration Agency (JAXA) has initiated research on a new generation rocket incorporating first stage reusability in partnership with MHI.

Technological innovation has led to three types of players competing in the market today. First, the traditional launch providers, such as United Launch Alliance (ULA), Arianespace, International Launch Services (ILS) and Mitsubishi Heavy Industries (MHI), which remain the benchmark for high-value customers such as government and military satellite operators. Alongside them are the so-called NewSpace launch providers, emerging companies that are transforming the market with innovative and reusable rockets, such as SpaceX, Rocket Lab and Relativity Space, which are typically targeting low-cost customers such as commercial and small satellite operators, but are also taking on cargo and crew transport missions from NASA to the International Space Station (ISS). And thirdly, small launch providers, niche companies specialising in small satellites, which have academic and research institutions as customers, such as Firefly Aerospace, Virgin Orbit and Astra.

To compete, there are differentiation strategies specific to the space economy. Such as reliability, a key factor for customers with high-value or time-sensitive payloads, such as national security satellites and manned spaceflight missions. Success rates of benchmark companies were hovering around 95-97% in early 2024. Another way to add value is to demonstrate flexibility by offering multiple options in terms of launch vehicle, location, frequency, orbit and price. The timeframe for companies to launch a satellite will also be reduced from years to weeks through vertical integration with private launch facilities. Rocket Lab has already secured strong commercial demand with commitments for its first 30 launches.

It also opens the door to complementary business lines, such as Relativity Space, which aims to offer its 3D printing to enable on-demand and in-orbit manufacturing of spacecraft and habitats. Manufacturing in space would take advantage of the unique conditions for industrial production provided by vacuum and microgravity to produce materials and structures that would be difficult or impossible to produce on Earth. There is interest in manufacturing semiconductors in space to potentially improve the process and possibly reduce power consumption by 60%. A significant part of the growth of the space economy is expected to come from the demand to use space to achieve productivity gains in traditional industries and five sectors (supply chain and transportation; food and beverage; state defence; retail, consumer and lifestyle; and digital communications) are expected to generate 60% of the global space economy by 2035. In addition, because of geopolitical instability, there is growing interest in security assurance, connected to the vision of space defence, as countries such as the US, China, Russia and India deploy military and intelligence satellites, as well as anti-satellite weapons, to enhance their deterrence capabilities.

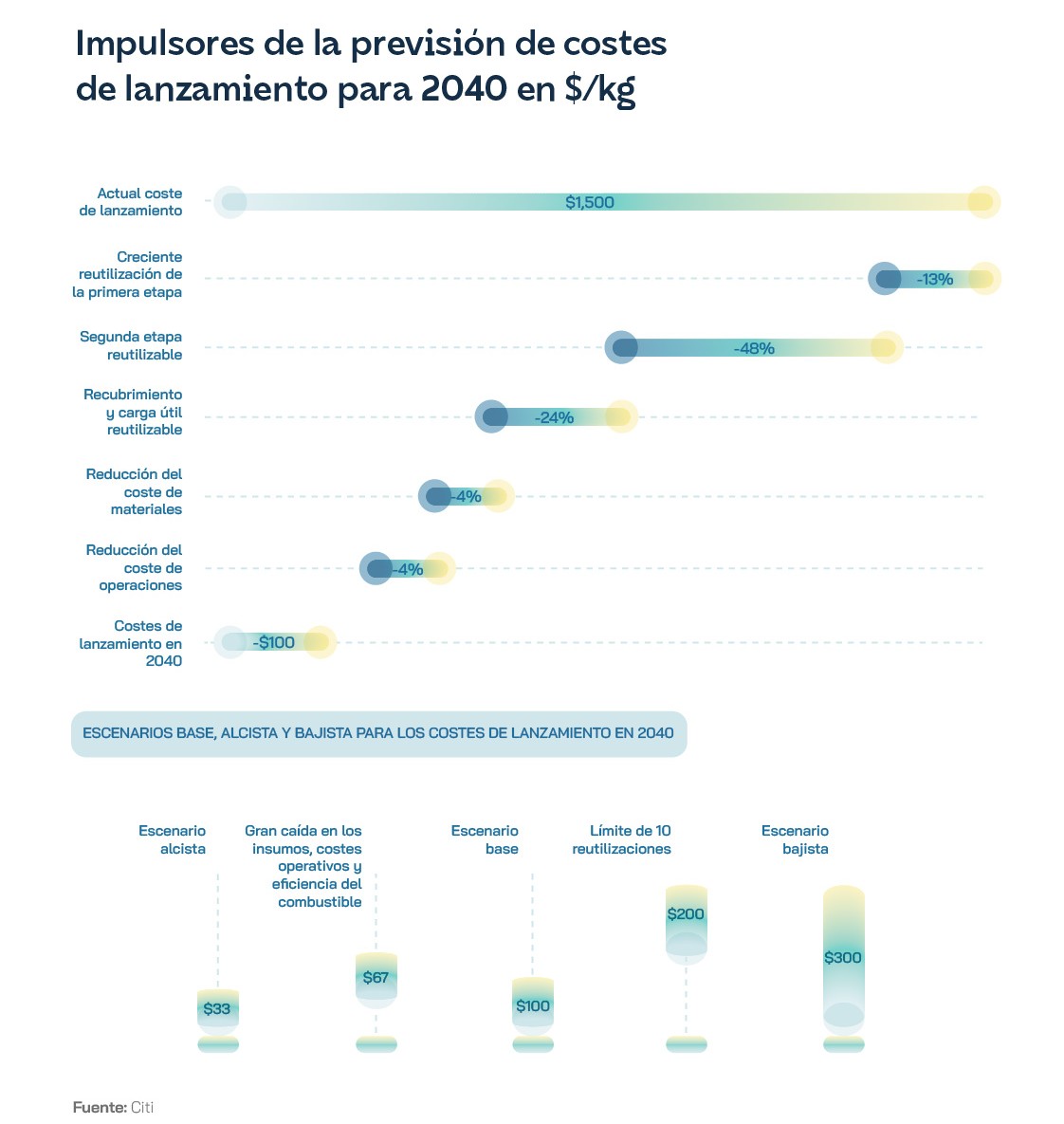

As for the cost of launching a payload into orbit, it depends on several variables, such as the payload's mass, size, shape and destination, as well as the type and configuration of the rocket, launch site and launch trajectory. The price of heavy launches to LEO has fallen from $65,000 per kilogram to $1,500 per kilogram, a decrease of more than 95%. In the first quarter of 2024, SpaceX was charging around $62m for the Falcon 9 launch, which could carry up to 22.8 metric tonnes to LEO, but only 4.5 to geostationary transfer orbit (GTO). Rocket Lab offered a dedicated launch service for small satellites called ElectronThe launch cost was around $7.5 million per launch and could carry up to 300 kg to LEO, and was expected to be under $5 million in the future.

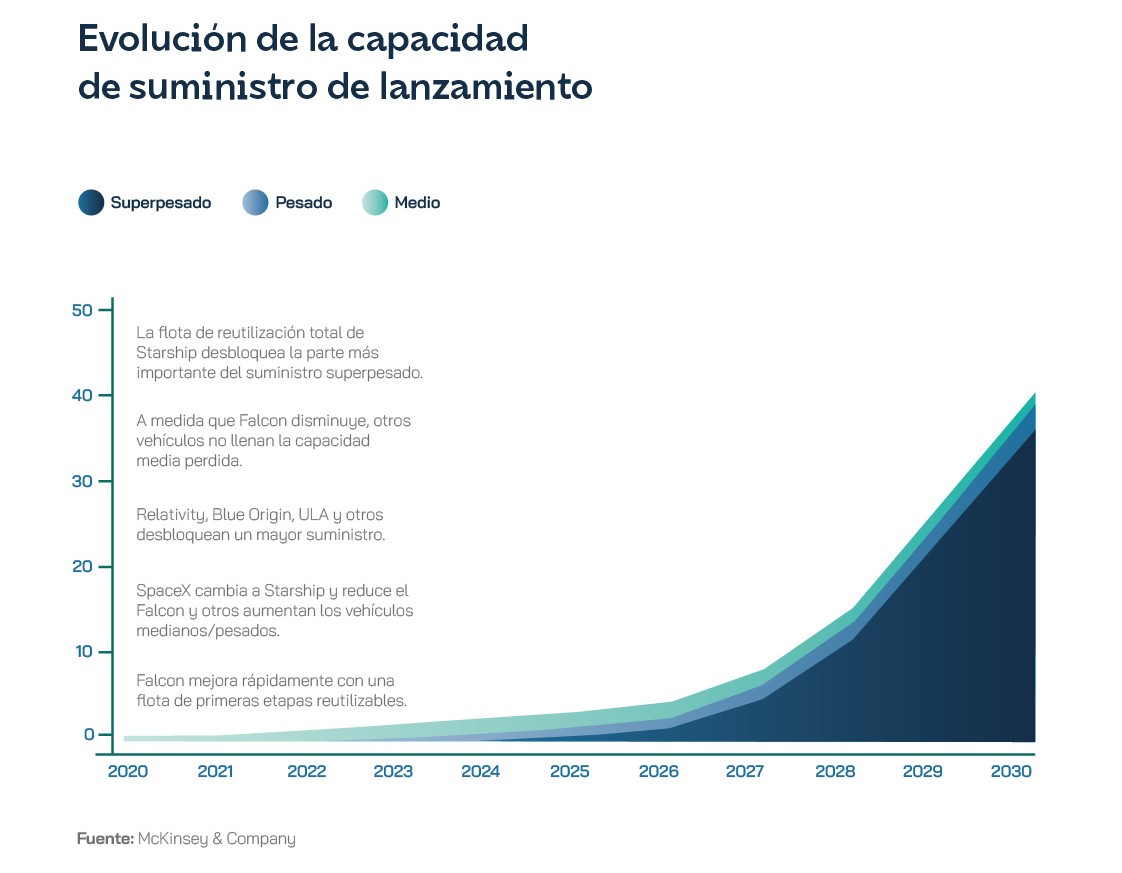

As for the market situation, in the short term, some estimates point to a likely capacity shortfall scenario of up to 11,700 tonnes (equivalent to approximately 300 heavy or 800 medium vehicles) until 2025, due to factors such as stock saturation or the historical gap between the first flight and the maximum launch rate of a new model, at a time when vehicles developed over the last few years are expected to appear. However, in the long term, the risk would be the opposite, that of an oversupply if SpaceX eventually decides to schedule a daily launch of its Starship. In the space economy as a whole, according to Euroconsult data, the technological dominance of the United States ($150 billion in business in 2023) distances it from Asian countries ($112 billion) and, above all, from Europe ($97 billion). McKinsey and the World Economic Forum estimate that the global space economy will be worth $1.8 trillion in 2035 (probably revisable to $2.3 trillion), compared to $630 billion in 2023. In that estimate, they include both 'backbone' applications (satellites, launchers and services such as broadcast television or GPS) and what they call 'outreach' applications, those for which space technology helps companies in all sectors to generate revenue. If so, it will have experienced an annual growth rate twice that of GDP and will be on a par with the semiconductor market. In the case of launches, they will be more frequent initially, with an average of 210 launches per year between 2023 and 2030, and 160 launches per year between 2031 and 2035, due to the emergence of super-heavy launchers.

Given this general dynamic, the European Space Agency (ESA) announced in May 2023 the Commercial Cargo Transportation Initiative (CCTI), a call for European companies to develop commercially robust cargo transportation systems, especially cheap, reusable rockets of their own. A similar initiative to NASA's Commercial Orbital Transportation Services (COTS) programme, which distributed $821 million to two companies (SpaceX and Orbital) and helped create the Falcon 9. The life cycle of the Ariane 5, from Franco-German company Arianespace, is coming to an end and the Ariane 6 could be delayed to 2025; while the conflict in Ukraine stalled Soyuz launches from French Guiana, so the issue has become strategic for the European Union. The funding policy for developing new vehicles must be strong enough to push European companies to the forefront of the New Space sector. Especially given the doubts that the sector still raises among private investors: in 2022, they only contributed €1 billion to technology companies, making it a small market compared to the US and China, where they raised six times as much. Apart from specialised venture capitalists such as Thiel's Founders Fund, Seraphim and NewSpace, it is strategic investors such as Airbus, In-Q-Tel and Lockheed Martin that dominate space technology investment. In fact, almost two thirds of investment came from non-aerospace and defence companies.

Potential European transport providers will have to compete with companies that not only designed the space stations, but have also developed the capability to carry cargo independently. A key problem in Europe is that ESA has never been able to muster resources comparable to those of peer institutions. Its budget in 2022 was 7.15 billion euros, compared to NASA's 22.86 billion euros, probably due to the fact that it is negotiated by a ministerial council of 22 representatives from member states.

Towards MIURA 5 with a stopover at Ariane 6

In the early hours of 7 October 2023, the Spanish company PLD Space made history by successfully completing the first successful launch of a private European rocket, MIURA 1, from the facilities of the El Arenosillo Experimentation Centre (CEDEA), belonging to the National Institute for Aerospace Technology (INTA). The flight lasted 306 seconds and MIURA 1 reached an altitude of 46 kilometres before splashing down in the Atlantic Ocean. The next step for the Elche-based company will be to carry out the first launch of MIURA 5 at the end of 2025 and start commercial activity in 2026, with the ultimate goal of exceeding 30 launches per year from 2030 onwards. In addition to the technical difficulties associated with the development of the launcher, its innovation team has added other challenges such as those posed by the Boost contract.! signed with the European Space Agency (ESA) to design a payload accommodation system on MIURA 5 to provide greater flexibility to its customers, in collaboration with Spain's OCCAM Space. MIURA 5 will be a two-stage orbital launcher dedicated to small satellites and will be able to provide dedicated mission and shared flight options. It will be programmed to offer a highly flexible service with 30 missions per year from different spaceports, including the historic Guiana Space Centre, where ESA has authorised Spain to have its own satellite launcher, which will facilitate PLD Space's operations.

Spain's dynamism and capacity to position itself at the forefront of a sector as exclusive as that of launchers highlights our country's potential in the foreseeable boom in the space economy. In April 2023, the Spanish Space Agency was born, a body that unifies all space policies and coordinates all services and activities in the sector to guarantee strategic action in the field of space. In terms of launchers, beyond PLD Space, innovative proposals have been deployed such as the RRTB project, led by the Spanish company Pangea and financed with European funds. It was aimed at investigating cost-effective ways of launching small rockets capable of carrying up to 500 kilograms of cargo into space, with the intention that they could be ready to fly by 2025. The challenge was to minimise the impact of these micro-launchers re-entering the Earth's atmosphere. At the institutional level, Spain's participation in launcher projects has been constant. Spain has contributed an investment of more than 228 million euros to the development of the new European rocket. Ariane 6launched into space in July 2024 from the European Spaceport in Guyana on its maiden flight. The rocket's software has been developed by Barcelona-based GTD, in collaboration with the company ArianeGroup, and controls the ignition and shutdown of the different engines, the separation of components, trajectory corrections and the orbital insertion of the satellites.