A compound to renew all sectors

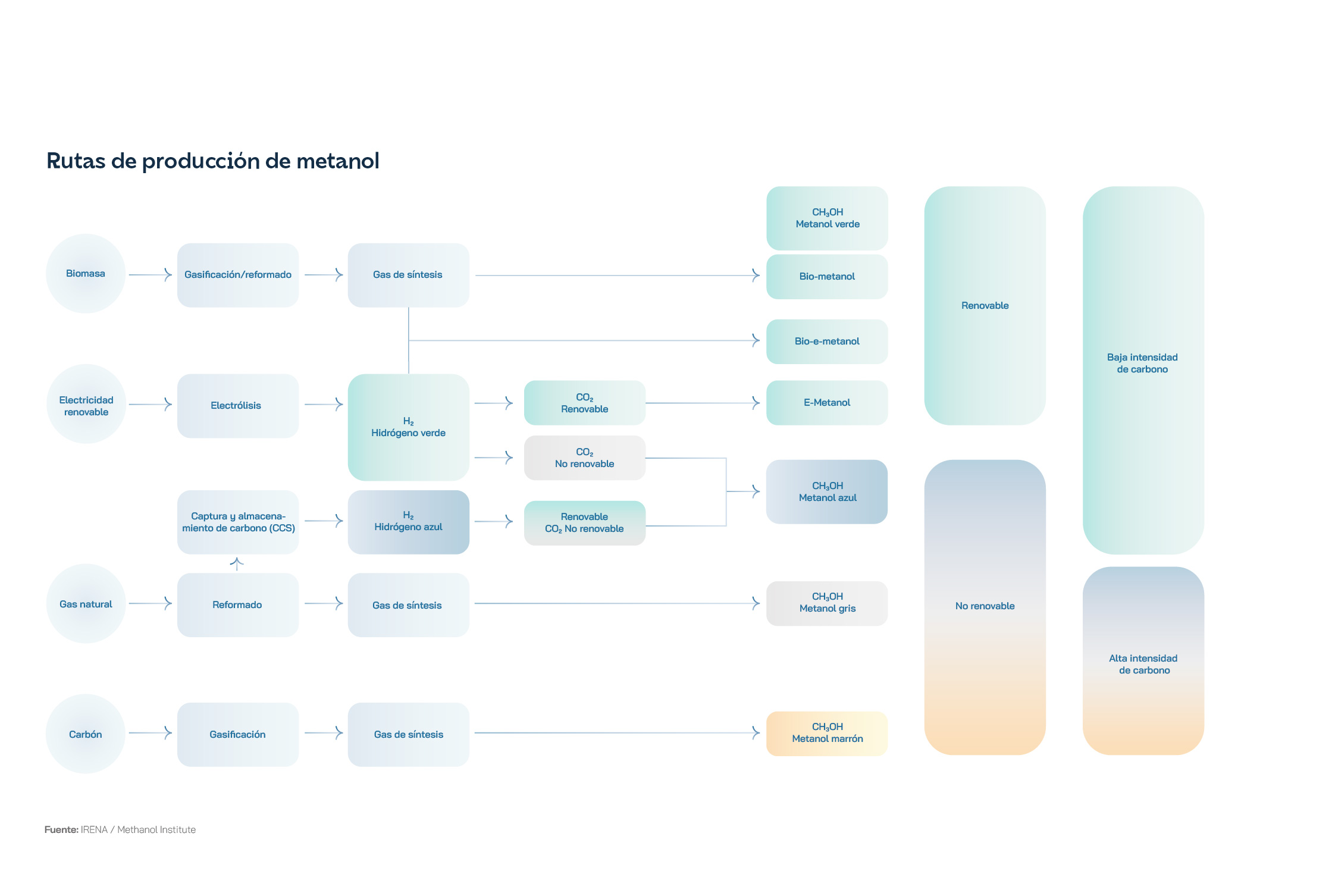

As with hydrogen, most methanol is currently generated from fossil fuels, through a chemical process of cracking and reforming natural gas. By using fossil fuels, this production method is not renewable. In addition, the reforming process uses reactors that require high pressures and temperatures to operate in order to convert methane into a mixture of carbon monoxide and hydrogen, known as syngas (synthesis gas) and then into methanol. This whole process uses a great deal of energy and, in turn, generates carbon dioxide as the main by-product. Overall emissions estimates vary widely depending on the end use of methanol, but it is estimated that producing one kilogram of methanol generates about half a kilogram of CO₂ - unsustainable without efficient capture methods and in an economy that seeks to minimise carbon emissions. Again, as with green hydrogen, the use of renewable energy sources could transform methanol production into a much more sustainable process and therefore of interest to 21st century industry.

Sustainable methanol production seeks alternatives that minimise greenhouse gas emissions and use renewable energy sources such as solar and wind power, among others. One of the main innovations is the use of captured CO₂ as feedstock. In this approach, CO₂ is captured from industrial sources or, in some cases, captured directly from the air, and combined with hydrogen produced cleanly by electrolysis of water. Electrolysis splits water into its hydrogen and oxygen components, and the hydrogen is combined with the captured CO₂ in a synthesis process to produce methanol. This method not only recycles carbon dioxide, but also uses renewable energy, reducing the carbon footprint of methanol production. Another very attractive method is electrocatalysis, which uses advances in chemistry and catalysis that are capable of transforming syngas and other similar mixtures, such as CO₂ and hydrogen, into methanol, using only clean electricity and a device known as an "electrolyser", which is basically a kind of inverted cell, where the electric current induces a chemical reaction. Several pilot plants are developing systems to convert CO₂ to methanol directly, to improve not only the efficiency but also the sustainability of the process. The cost of emerging technologies, such as CO₂ capture and water electrolysis, can be high compared to traditional, fossil fuel-derived methods. In addition, the infrastructure needed for these technologies is still under development, and significant investment in R&D is required to scale up their implementation, as well as progressive policies and regulations that encourage the implementation of more sustainable syntheses.

The market acceptance of green methanol will largely depend on the economic competitiveness against alternatives that are currently even cheaper. Another alternative is the production of biomethanol from biomass. As in the manufacture of bioethanol, described in the chapter on sustainable fuels, biomass, which includes agricultural, forestry and municipal waste, can easily be converted into synthesis gas by various chemical and biological processes. This syngas can then be processed into methanol from a renewable carbon source, which promotes the circular economy, waste reduction and, above all, reduces our dependence on fossil fuels. However, as with bioethanol and biodiesel, it is important to prioritise the use of waste resources and not to use raw materials that could be used to feed people and animals in the production of biomethanol, to avoid serious supply problems.

Green methanol, along with similar compounds such as ethanol, has gained recognition in recent years as an efficient and versatile alternative to fossil fuels. It is cheaper to produce than other synthetic alternatives and is also less flammable and therefore safer than gasoline and other petroleum derivatives. Apart from these unique chemical properties, the possibility of generating "green" methanol from renewable energy and captured and recycled carbon dioxide offers a great advantage in terms of emission reductions and sustainable alternatives, free of geopolitical tensions. For example, in the transport sector, methanol stands out as a viable and sustainable alternative to traditional fossil fuels. It can be blended with gasoline in different ratios that not only offer comparable performance to gasoline-only engines, but also reduce emissions of pollutant gases such as carbon monoxide (CO) and nitrogen oxides (NOx). Methanol also has a high octane rating, which means it can improve engine performance and reduce the tendency for petrol to detonate, providing a safer alternative.

Like hydrogen, methanol can also be used in fuel cells, instead of burning it, to produce electrical energy directly. Methanol fuel cells, also known as DMFCs, convert the chemical energy of methanol directly into electricity through an electrochemical reaction, generating only water and carbon dioxide as by-products. If the methanol has been produced from recycled CO₂, the total emissions from this combustion are emission neutral, due to the closed carbon cycle. These DMFC batteries are especially useful in portable applications, such as mobile phones, laptops and other portable electronic devices, due to their high energy density and the ease of handling methanol compared to alternative fuels such as hydrogen, which requires storage at high pressure or extremely low temperatures. The ability of methanol, which is liquid and stable at room temperature, to be transported and stored facilitates its integration into consumer devices and portable power equipment, as well as into existing transport infrastructures designed and prepared to work with liquid products and fuels such as gasoline.

In the maritime industry, methanol has also positioned itself as an effective alternative to traditional fuels, which are often highly polluting. The need to comply with stricter environmental regulations, such as those imposed by the International Maritime Organisation (IMO) for the reduction of sulphur and nitrogen oxide emissions, has driven the search for cleaner alternatives. Unlike petroleum products, which often contain pollutants such as sulphur, methanol (especially green methanol) offers a cleaner combustion, proposing an attractive solution for operators of large ships. Its use in the maritime industry not only reduces pollutant emissions, but also has the potential to reduce operational costs associated with environmental compliance. In addition, thanks to the expansion of infrastructure for methanol distribution and storage, adoption in the maritime sector is accelerating in recent years. In 2023, Ørsted began construction of its FlagshipONE plant in northern Sweden, which will produce 50,000 tonnes of green methanol per year from 2025 to supply a global fleet of powered ships. And in the same year, Canadian shipping company Waterfront Shipping announced that it had completed the world's first net-zero transatlantic voyage, using methanol produced from green hydrogen as a carbon-neutral fuel.

Electricity generation is another area where methanol has shown great potential. Although still under development, methanol can be used in gas turbines and combustion engines for electricity production. Methanol's ability to be used in these power generation systems offers an interesting alternative to traditional fossil fuels, especially in applications where emissions reduction is crucial. First, because the combustion efficiency of methanol is superior to that of most fossil fuels and, second, because methanol can be produced sustainably. Moreover, it is possible to capture the carbon dioxide emitted during methanol combustion and recycle it back into methanol again, an optimal example of a circular, waste-free economy. In China, for example, the use of methanol as a fuel has grown by 25% per year since 2000, one of the Chinese government's major efforts to achieve its climate neutrality goals by 2060. Research and development in methanol production, storage and use technologies will be crucial to harness its benefits and overcome current challenges. Taken together, these applications demonstrate that methanol not only has the potential to improve efficiency and reduce emissions in various sectors, but can also play an important role in the transition to a more sustainable energy future.

Today's chemical industry produces thousands, millions of different products (plastics, materials, medicines, additives) from a few simple building blocks, often derived from fossil fuels and finite resources. Among them is methanol, a key building block in the Lego game of chemists and engineers, fundamental both for its uses as a solvent and for its applications in the synthesis of other key products. For example, methanol serves as an important intermediate in the production of formaldehyde, another of these "base" chemical compounds for the preparation of so many other products. Formaldehyde is obtained through the oxidation of methanol in the presence of a catalyst, usually a metal oxide, and has extensive applications in the resin manufacturing industry, such as melamine, which is popular in the production of building materials, furniture and finishes. Formaldehyde-derived resins are also crucial in the manufacture of adhesives, coatings and paper products. Its ability to react with other substances to form polymers makes it an indispensable component of many industrial products and plastics.

In this sense, it is key to identify the opportunities of green methanol as a more sustainable alternative to fossil methanol. Through sustainable methanol synthesis, we could reduce the chemical industry's dependence on petroleum-based products and offer products of the same quality and durability, but much more sustainable and environmentally friendly. Although producing green methanol is still more expensive than producing methanol from fossil sources, some studies by major financial institutions such as ING suggest that consumers would hardly notice the change in raw materials in the price of end products such as a plastic bottle (which would increase by approximately 2%) or a car (which would be between 0.5% and 1% more expensive, despite using much more plastic, the increase would be proportionally smaller).

Another key product derived from methanol is acetic acid, which is produced by the carbonylation of methanol in the presence of a ruthenium or iridium catalyst. Acetic acid (which is also the "active ingredient" in vinegar, a product of the oxidation of ethanol in wine and cider) is a vital chemical compound in industry, used mainly in the production of vinyl acetate, which in turn is used to make plastics and synthetic fibres. It is also used in the production of terephthalic acid, which is an essential precursor for the manufacture of polyesters such as PET. In addition, acetic acid finds applications in the food industry as a preservative and in the production of pharmaceuticals and cosmetics. Again, a transition to green methanol would result in the decarbonisation of these industries, which is particularly important in the case of plastics and pharmaceuticals, as we need to find alternative routes to produce them that are not dependent on oil to ensure their long-term viability. Methanol is also a key product in the production of other plastics and polymers, such as polymethylmethacrylate (PMMA), commonly known as acrylic, used in a wide range of applications, from lenses and displays to building materials and road signs. In addition, methanol is essential in the manufacture of speciality chemicals, such as chloromethanes, commonly used as solvents in industry, and esters, important in the production of flavourings, fragrances and plastics.

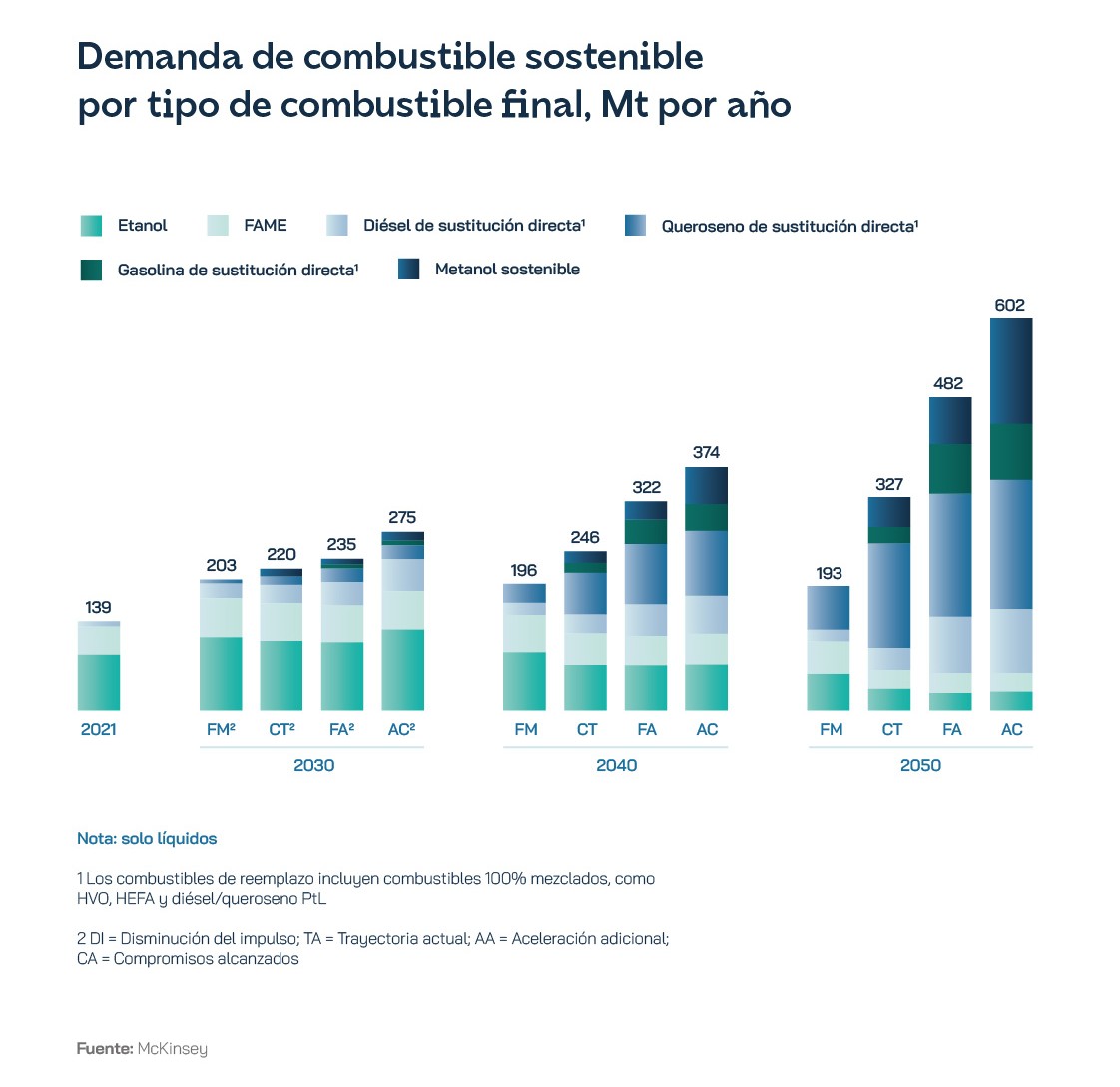

In short, methanol is an essential feedstock in the chemical industry, fundamental to hundreds of chemical reactions and the synthesis of chemicals as diverse as fuels, plastics, additives and medicines. As demand for chemicals and materials continues to grow (and dependence on fossil fuels decreases), green methanol will play a key role in developing and manufacturing industrial products in a more sustainable way. A commitment to green methanol through innovative technologies and policies that favour its production will be crucial to reduce greenhouse gas emissions and diversify both our energy sources and dependence on different industrial feedstocks. For the World Economic Forum, despite all the potential downsides of scaling up production technologies, methanol is the fuel of the future that everyone overlooks. Because it is not just a fuel, but a key part of the decarbonisation of the chemical industry that can reduce emissions by up to 95%. A very promising alternative indeed.

Energy alternative in search of a market

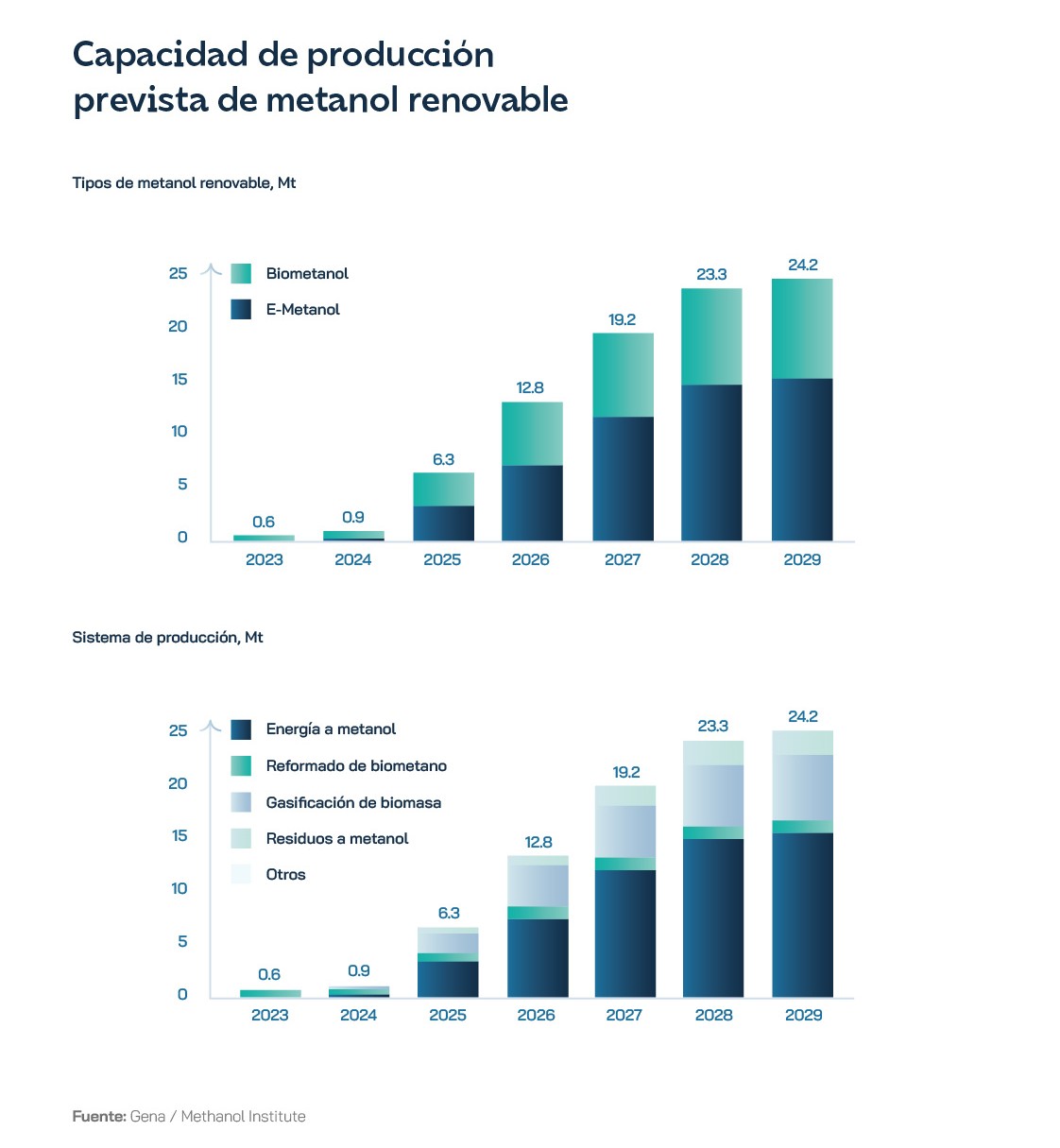

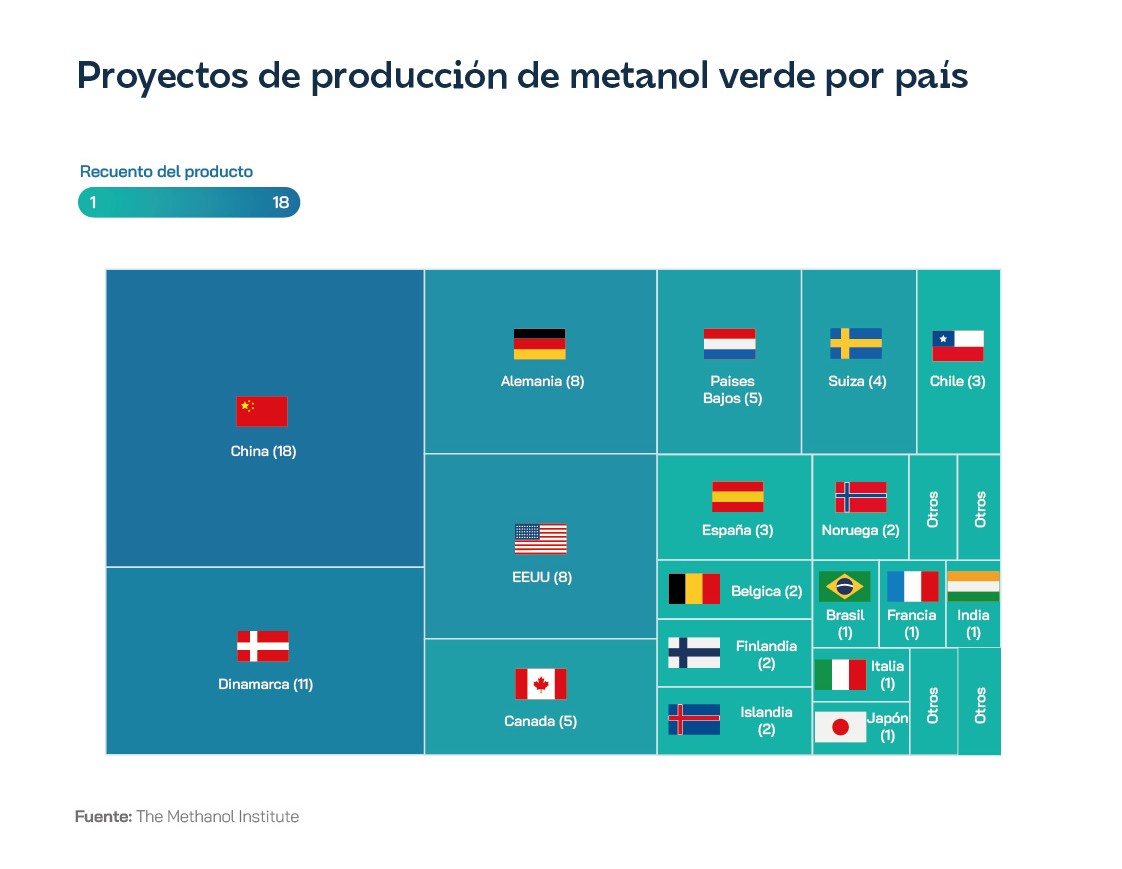

In July 2024, the Methanol Institute counted 170 renewable methanol production projects worldwide, up from 90 two years earlier, with a total expected generation capacity of 20.87 million metric tons in 2027 (just 0.2 million tons in 2021) and 26.72 million tons in 2029. In the case of e-methanol, estimates attributed 12.63 million tonnes in 2027 and 16.43 million tonnes in 2029, while biomethanol projects are expected to reach 8.24 million tonnes and 10.29 million tonnes, respectively, during the same periods.

Biomethanol (green methanol) is produced from biomass: waste and by-products from forestry and agriculture, such as black liquor from the pulp and paper industry, biogas from landfills, wastewater and municipal solid waste. Electronic methanol (e-methanol, green or blue) is obtained by combining captured CO2 with hydrogen from renewable electricity. Compared to conventional fuels, renewable methanol reduces carbon dioxide emissions by up to 95%, cuts nitrogen oxide emissions by up to 80% and completely eliminates sulphur oxide and particulate matter, making it a desirable target for the sustainable energy transition.

Among the reasons for predicting a growing role for renewable methanol in the global energy sector are the expansion of green energy generation capacities, key to lowering production costs, as electricity accounts for between 40% and 70% of the costs; the optimisation of the conversion chain, thanks to the development of advanced copper and zinc-based catalysts for CO2 hydrogenation, and especially advanced electrolysers; the notable increase in the number of national hydrogen strategies; and the increased acceptance and deployment of carbon capture, utilisation and storage. In the latter case, a major problem for e-methanol producers remains the acquisition and transportation of CO2: if an e-methanol plant is not connected to a distribution pipeline, it faces logistical challenges with complex costs, with the aggravating factor that transportation means increased emissions in the life cycle of the e-methanol produced. In the United States, therefore, work is being done on the basis of generating synergies between ethanol and ethanol production. Processes capable of generating a constant supply of highly concentrated, low-cost biogenic CO2 are seen as natural partners in the creation of e-methanol.[iii].

Ultimately, only the remaining doubts about the technology's potential to scale up continue to dampen expectations in many sectors. Under current market conditions, e-methanol production is far from competitive with conventional methanol production from fossil fuels (natural gas in 65% of cases and coal through gasification processes in the remaining 35%). The world's leading methanol producer, the US group Methanex, moved around an average price of $333 per tonne in 2023, compared to $397 per tonne in 2022. A study carried out by Italian researchers estimates that even at 450 euros per tonne it is not profitable to operate an e-methanol facility, so that its net present value (NPV) would be negative by approximately 21 million euros. To test this, they designed a plant capable of producing 500 kg/h of renewable methanol from green hydrogen and captured carbon dioxide. The final levelised cost was 960 euros per tonne (approximately 175 euros per MWh), more than double the price of methanol on the international market (450 euros/t) and three times higher than the average selling price achieved by Methanex. In the long term, around 2035, they believe that profitability could be achieved by a combination of a 25% higher cost of renewable methanol, a 15% reduction in the capital cost of the electrolyser and a 25-30% reduction in the cost of electricity.

So far this has only happened due to certain recent geopolitical circumstances. According to S&P Global Commodity Insights accounts, methanol (basically conventional) traded at lower prices, in dollars per tonne, than MGO (marine gas oil), HFO (heavy fuel oil) and LNG (liquefied natural gas) at the Rotterdam hub between November 2021 and March 2024. Natural gas prices spiked towards the end of 2021, amid a pre-winter supply shortage that experts attribute to Russia's pre-war strategy, and several spikes followed after the Russian invasion of Ukraine in February 2022. This spike affected LNG, but also put upward pressure on (non-renewable) methanol, most of which is made from natural gas. Between 2023 and 2024, methanol transport trade patterns were altered by conditions in the Panama Canal, where traffic was affected by natural hazards, and in the Suez Canal, which was affected by instability in the Middle East. The new trade patterns allowed, for example, Europe to enjoy better supplies from the Atlantic basins, but ultimately threatened to further drive methanol market adjustments and even begin to influence prices.

The future of renewable methanol has one of its greatest areas of expansion at sea. The International Maritime Organisation (IMO) has committed to reducing shipping emissions by at least 70% by 2040, reinforcing this green fuel as an undoubted decarbonisation alternative for the sector. In 2023 there were only 27 methanol-capable ships in service, but 143 newbuilding orders were placed that year. If added to previous orders, the methanol-capable fleet could rise to 227 units, according to Clarksons data. Methanex puts that figure at more than 260 new methanol ships ordered from shipyards around the world, which would mean that for the first time, the volume of orders would exceed that of LNG carriers. According to Platts Analytics, at least 228 methanol dual-fuel vessels were on order in the first half of 2024 for delivery in 2028.

Parallel to these movements, another defining trend in 2023 was the increase in the renewal of methanol engines. The order book has grown far beyond expectations. By the end of the year, 192 two-stroke engines with a power output of between 8 MW and 80 MW had been sold in the marine market. Most of the orders were for large container ships requiring three to five auxiliary engines. For example, the world's first carbon-neutral container ship, the Laura MaerskThe new vessel, which operates with a MAN Energy Solution two-stroke engine for propulsion and two HiMSEN medium-sized four-stroke engines, has received orders for the production of 177 methanol-powered engines for 42 vessels. For its part, HD Hyundai has received orders to produce 177 methanol-powered engine units for 42 vessels. Methane propulsion engines are not only produced for new ships: several container shipping lines want to use them to retrofit existing vessels. Maersk selected the Zhoushan Xinya yard, south of Shanghai, for the Maersk Halifax The 15,282-TEU ship could run on methanol, the first of 11 planned engine modernisations.

The Maritime and Port Authority of Singapore, the world's largest marine bunkering hub, has called for proposals to implement a stable supply of low-carbon methanol from 2025. The country is preparing to approve national standards for the supply of methanol as a marine fuel. It aims to establish itself as a strategic point in two of the world's largest green corridors, the Green Corridor from the Port of Rotterdam to Singapore and the Silk Alliance Green Corridor, which stretches from Shanghai to Singapore. In Japan, Maersk has signed a memorandum of understanding with the city of Yokohama and Mitsubishi Gas Chemical for the development of a green port methanol bunkering infrastructure. In the EU, Equinor is supplying bio-methanol from Norway to the vessel Laura MaerskOCI Global planned to do the same from mid-2024 with Xpress Feeder Lines for its fleet. At COP28, the EU-Catalyst partnership between the European Commission, Breakthrough Energy Catalyst and the European Investment Bank announced its support for Ørsted's FlagshipONE project, Europe's largest electronic methanol plant. Energy transition makes strange companions: Taiwan's Evergreen has signed a memorandum of understanding with the Port of Shanghai to use its green methanol bunker.

However, there are numerous calls not to shoot up expectations. Renewable hydrogen-based marine fuels, such as ammonia and methanol, are not expected to be more price competitive with fossil fuels until after 2040. And because of their density and lower calorific value, methanol fuel tanks are about 2.5 times larger than oil tanks for the same energy content. Green methanol production was admittedly low in 2021, less than 0.2 million tonnes per year, compared to 98 million tonnes of conventional methanol made from fossil fuels, whose production is not only not going to stop, but could reach 500 million tonnes by 2050. Even so, it would still release 1.5 gigatonnes of carbon dioxide per year, according to estimates by the International Renewable Energy Agency (IRENA), which continues to maintain it as an alternative to reduce climate change. The price of e-methanol will be very sensitive to the price of the energy needed to produce green hydrogen, which represents 77% of the total cost, mainly due to the cost of electricity and electrolysis plant operations. According to calculations by the European Commission's European Smart Grid Technology and Innovation Platform for Energy Transition (ETIP SNET), the minimum price of renewable hydrogen will not fall below €2.5 per kilogram, so subsidies for the manufacture of low-emission synthetic fuels such as e-methanol will need to be approved.

Europe is home to four major shipping companies (Maersk, MSC, CMA CGM, Hapag Lloyd), representing 52% of the global market, so it is a key player in this whole process. Several of them are turning to methanol as a fuel for decarbonisation. However, associations such as CleanTech for Europe have been warning that it will only succeed if it benefits from a clear regulatory framework and a functional value chain, providing long-term certainty and capable of attracting investments over 30 years. The two carbon pricing systems established by the EU for maritime transport are based on the Emissions Trading Scheme (ETS) and the FuelEU Maritime mechanism, which comes into force in 2025. Both models are conditioning the strategic decisions of large companies. Under current circumstances, for example, it is estimated that ten container ships could avoid paying around 277 million euros in maritime penalties under the FuelEU mechanism over five years (2030-2034) by adding a single e-methanol-powered ship to their fleet. This is a saving far in excess of what it would cost to build.

Beyond shipping, the traditional chemical sector accounts for approximately 50% of global methanol demand, ahead of energy and fuel-related applications at 30%. The methanol market reached approximately 91 million tonnes in 2023, driven mainly by demand growth in China, with imports reaching an all-time high of 14 million tonnes, thanks to the recovery of the chemical sector and the high levels of use it is achieving as a vehicle fuel. Methanol can be blended with gasoline in small quantities for existing vehicles and in high proportions for others powered by flexible fuel or directly dedicated to methanol. Blends range from 5% to 100% ('M5' to 'M100'). Some 30,000 taxis and passenger cars are already methanol hybrids and 4,000 heavy trucks run on M100 fuel in China. In total, they account for about one million tonnes of annual demand.

The Chinese government is encouraging this trend: it approved three key national methanol fuel standards in 2023, and by the end of that year there were 140 active refuelling stations. Car manufacturer Geely, one of the main drivers of this technology in the country, intends to develop a methanol-based ecosystem in the city of Handan through its Farizon Auto brand. It plans to use renewable energy, wind and solar power, and to reach a production capacity of precisely one million tonnes. Methanol currently powers industrial boilers, furnaces, domestic heating, generators, fuel cell systems and, above all, cookers in China, the largest total demand component in the country, accounting for more than 50%. Significantly, the 2023 Asian Games cauldron will burn with methanol produced in Henan province, in a new plant also funded by Geely using technology from Iceland's Carbon Recycling International. It is the first facility of its kind in the world capable of commercial-scale production from carbon dioxide and hydrogen gases from waste.

To understand China's strategic interest in methanol, consider that in the next 15 years, up to 80% of the Asian giant's oil supply may have to be imported, which is spurring the search for alternatives at home... and abroad. On the occasion of the Third Belt and Road Initiative (BRI) Conference in Beijing, Chinese and Nigerian officials announced the establishment of a methanol plant in eastern Nigeria; and China Road and Bridge Corporation and Nigeria's BRASS Petrochemical will collaborate on the construction of a port, with a planned capacity of two million tonnes of methanol destined for China.

Numerous methanol production facilities are being promoted by the Asian giant in BRI countries to ensure a stable supply, mostly based on natural gas and coal as feedstock. In its agreements with other countries, Beijing also takes the opportunity to partner with research institutions and local governments to develop advanced methanol production and utilisation technologies. Globally, of the 30 ports that can now offer large-scale bunkering (bunkering) methanol plants, five are in China. Asia's role in managing the electrification of industry will be key to achieving global climate change goals. Under a stable policy scenario, which remains to be seen, production of all major industrial materials will increase by 2030, including ethylene (up 27%), methanol (17%), aluminium (13%) and paper (12%), as well as steel and ammonia (10%) and cement (8%). This growth will occur mainly in developing Asia.

In this scenario of increasing demand pressure in global markets, organisations such as the Methanol Institute denounce that in Europe, investors, producers and stakeholders in the alternative fuels market face considerable uncertainty due to the lack of harmonised standards and definitions of what constitutes a low-carbon fuel. Although advanced biofuels, including methanol, are recognised as RFNBOs (renewable fuels of non-biological origin) from July 2023, the European Commission's proposed implementation of the Union Database for Biofuels (UDB) excludes automatic certification of biomethane and biomethane-based biofuels, such as biomethanol, when they are produced through a mass-balanced chain of custody from non-EU gas networks. Producers warn of the risk of this measure creating a trade barrier preventing the import of biomethane and biomethanol into the EU, and argue that it could have major implications for the decarbonisation of intra-European and international shipping. Furthermore, it could result in such fuels, produced outside the EU, not being certified under the requirements of the Renewable Energy Directive II (REDII), so that they would not count towards meeting FuelEU Maritime's carbon intensity reduction targets. And the revision of the Renewable Energy Directive (RED III) goes one step further and proposes to move from a target of 32% to at least 40% of renewable energy sources in the overall EU energy mix in 2030. In addition, the Methanol Institute calls on Brussels to recognise evidence of CO2 storage emitted by third countries in European legislation.

Renewables fuel methanol green shoots

From among the 239 applications submitted to the third call of the Innovation Fund, which includes industrial and large-scale decarbonisation projects, the European Commission selected 41 proposals to which it will allocate 3.6 billion euros to bring innovative technologies to the market in energy-intensive sectors, hydrogen, renewable energies and the manufacture of components for energy storage and renewable energies. One of the selected projects is GREEN MEIGA, coordinated by Iberdrola, which proposes an innovative and integrated technological approach for the production of e-methanol. The project consists, on the one hand, of an integrated plant with a hybrid hydrogen production system, comprising solid oxide electrolytic cell (SOEC), proton exchange membrane (PEM) and alkaline (alpha-alpha) co-electrolysis systems. It also foresees an integrated e-methanol production system, and an advanced CO2 capture system integrating enzyme-based and direct air capture technologies.

Another of the selected ideas involves the Spanish company Forestal del Atlántico. The TRISKELION project aims to produce green methanol also from hydrogen and captured CO2. The hydrogen is produced by electrolysis with electricity from additional renewable sources, as it envisages the opening of a wind farm in the vicinity of the facility. And CO2 is captured from an existing cogeneration plant. The project will also produce green liquid oxygen through an oxygen liquefaction system and liquid oxygen storage.

These are two of the initiatives that have put Spain on the map of green methanol production in Europe and the world, especially since the announcement of the alliance between energy company Cepsa and global shipping giant Maersk's subsidiary C2X to build a green methanol plant in Huelva, at an estimated cost of up to $1.1 billion. Once completed, the plant will produce 300,000 metric tons of environmentally friendly methanol per year, making it one of the largest facilities of its kind in Europe. The Port Authority of Huelva has already granted administrative authorisation to the company Phoenix X Spain, a subsidiary of the Danish group, to build and operate the green methanol plant in the port area with a concession of almost half a million square metres of public domain. Cepsa is not the only project announced in the Andalusian province. The Ansasol Group, which specialises in green hydrogen, claims that the green methanol plant it is also planning in the Port of Huelva will be the largest in Europe. The MetGreenPort project will start operating in 2027 and will produce green methanol using green hydrogen generated by water electrolysis, for which it will be supplied with renewable energy and carbon dioxide captured from surrounding industries.

The dynamic is extending to other parts of the country. Repsol plans to start up a biomethanol plant in the Catalan municipality of El Morell in 2028 with a capacity of 237,000 tonnes. In the Leonese municipality of La Robla, meanwhile, the Spanish companies Reolum and Tresca Ingeniería, together with the investment fund Incus, will start up the La Robla Green project, which includes a biomass energy generation plant, Roblum, and an e-methanol plant. The H2OSSA complex, driven by ETFuels, expects to reach 100,000 tonnes of biomethanol by 2028, a volume similar to that which HyFive expects to achieve at its Gijón plant in 2027.