Crisis and recovery of the Spanish economy after two years of COVID-19

The Observatory's researchers, José E. Boscá, Rafael Doménech, Javier Ferri, Vicente Pallardó y Camilo Ulloa present the explanatory factors of the economic cycle, the crisis and the recovery of the Spanish economy after two years of COVID-19.

This new version of the Observatory updates the study of the determinants of the business cycle in Spain with the information available up to the fourth quarter of 2021, including the important revision on GDP and its components carried out by the INE. To do so, they use a shock decomposition based on the EREMS macroeconomic model (see Boscá et al. 2020a). In this way, it is possible to analyse, characterise and preliminarily assess the factors that have contributed to the sharp swings in macroeconomic variables during the acute crisis phase and the subsequent recovery of the Spanish economy associated with COVID-19.

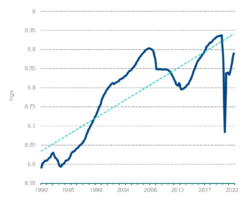

GDP growth per person of working age

Despite the strong recovery of the Spanish economy in the second half of 2021, GDP per PET in Q4 2021 was still 4.61 Q3Q2021 below its level in Q4 2019..

The recovery of activity during 2021 is mainly explained by structural demand factors, whose contribution in the last three quarters has been 92% per cent of year-on-year GDP growth, compared to 8% of supply shocks.

On the supply side, the recovery in total factor productivity in 2Q2021 appears to have been a one-off event, which did not continue in the second half of 2021. However, wage margins, which had been detracting several percentage points of growth in previous quarters, reduced their negative contribution in the second half of 2021.

With regard to structural demand factors, the contribution of those linked to external demand, to the improvement in private consumption and investment, and to credit stand out.

The labour market: unemployment and vacancies

The two years of the pandemic are characterised by the little change in vacancies and unemployment rate compared to previous crises. The vacancy/unemployment ratio has made a round trip, with decreases in 2020 and increases in 2021, until returning in the last quarter to a level that shows a slightly higher labour market tightening than that observed in 4Q2019.

After reaching a peak in recent decades in 1Q2021, the share of compensation of employees in GDP at factor cost at the end of 2021 was at levels similar to those of 1995 and its historical average since then.

The behaviour of the GDP deflator and real wages

By the end of 2021, the year-on-year growth rate of the GDP deflator was 21 Q3YoY higher than the historical average (2.21 Q3YoY), and it is demand factors that the model identifies as driving the marked rise in the rate of inflation during 2021.

According to the advance estimate of the Quarterly National Accounts (QNA), published by the National Statistics Institute (INE), in 4Q2021 there was a decline in real wages that was exclusively due to supply factors, which detracted 4.4 pp, mainly due to the contribution of wage and price margins, as demand factors and credit contributed 2.6 pp to their evolution.

Two years of COVID-19: a comparative view between Spain and the EU8

A comparison of the Spanish economy with the most advanced economies in the EU shows that the pandemic has increased private debt, although the favourable spread for Spain is still maintained. However, the unfavourable public debt-to-GDP spread between Spain and the EU8 has increased from 15pp in 2019 to 20pp in 2021.