The Economic Cycle Observatoryinitiative of BBVA Research, Fedea and the Rafael del Pino Foundation, have jointly launched the twelfth edition of the Observatory on the Economic Cycle in Spain, under the title "....Cyclical behaviour of GDP and consumption up to Q2 2024". This Observatory analyses and quantifies the influence of a broad set of structural factors that determine business cycles with the help of a model designed by researchers from the three institutions involved.

In this edition of the Cycle Observatory the study of the determinants of the economic cycle in Spain is addressed with complete information up to the end of the year. second quarter 2024.

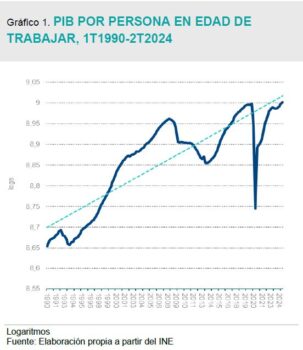

GDP growth per person of working age

Since the previous edition of the Observatory, there have been favourable changes in the evolution of inflation and GDP, which have continued to perform better than expected in mid-2023.

The gap of GDP per working-age person (WAP) with respect to its trend level stands at -1.3 pp in 2Q2024.The annual growth rate of GDP per PET was above its trend average.

Supply shocks have contributed negatively, with about -0.2 pp of annual GDP growth per PET in 2Q2024.. In the first half of 2024 the positive contribution of lower price margins and TFP are the main drivers of GDP growth per PET.

Shocks to consumer and housing demand and credit have also contributed positively to GDP growth.

The labour market: unemployment and vacancies

The indicator of labour market tightness in Spain remains high. Compared to the fourth quarter of 2019, the ratio of vacancies to unemployment has grown by 51%, from 3.4% to 5% (1.6 pp)..

The first half of 2024 has been positive in terms of productivity growth, mainly due to the good performance of GDP per hour worked.

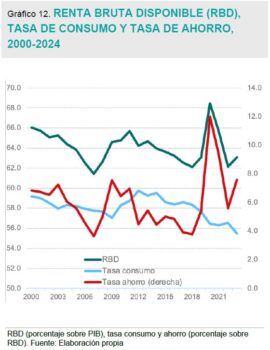

The behaviour of private consumption

Private consumption per PET has not yet recovered to its pre-pandemic level, standing 41 Q3DPT below the 4Q2019 level and 6.21 Q3DPT below the peak reached in 4Q2007..

Despite the positive contribution of supply factors, the lower growth of private consumption relative to GDP has been explained by the negative contribution of demand factors, among which changes in consumption and housing preferences stand out, probably capturing the disincentive on house purchases from the rise in the price of this asset and the improvement in expectations about the general economic situation.

The negative performance of consumption in relative terms, together with the increase in disposable income over GDP, explains the increase in the savings rate..

Determinants of household consumption in the Spanish economy in the European context

International comparison shows that household consumption in Spain has shown a 9 points higher share of GDP compared to the EU8 benchmark countries (Austria, Belgium, Denmark, Finland, France, Germany, the Netherlands and Sweden) during the 21st century.

In the last biennium, Spain has recorded a remarkable recovery in the five variables that influence private consumption: savings, debt, employment, wages and disposable income.. Of note is the deleveraging of households and the recovery of the savings rate, which increased to 14.21GDP3Q in 1Q2024.

Despite recent positive developments, productivity performance remains a challenge for Spanish wage growth and private consumption growth.