The Economic Cycle Observatoryinitiative of BBVA Research, Fedea and the Rafael del Pino Foundationhave jointly launched the eleventh edition of the Observatory on the Business Cycle in Spain, entitled "Business Cycle and Investment in Spain after the revision of the Quarterly National Accounts". This Observatory analyses and quantifies the influence of a wide range of structural factors that determine economic cycles with the help of a model designed by researchers from the three institutions involved.

This time the focus is on the year from the third quarter of 2022 to the second quarter of 2023. This version of the Observatory has focused on assessing the factors that explain the cyclical behaviour of output, the performance of the labour market and of non-residential private investment. It also introduces a comparative exercise between the Spanish economy and the EU8 in which the evolution of aggregate investment is analysed.

Business cycle and investment in Spain after the revision of the Quarterly National Accounts

This new edition of the Observatory tackles the study of the determinants of the business cycle in Spain with the information available up to the second quarter of 2023, taking into account the important revision carried out by INE in September of this year, which has affected the Quarterly National Accounts series of Spain since the first quarter of 2020.

It analyses and assesses the factors that have contributed to the stabilisation of the economy after the COVID-19 crisis, taking into account that the exit from the crisis coincided with an environment of strong changes in the relative prices of goods versus services, important monetary and fiscal stimuli, disruptions in global production chains, and changes in labour market regulations.

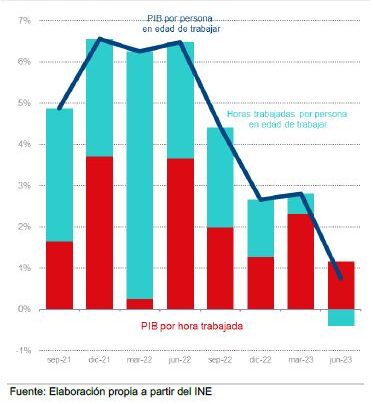

GDP growth per person of working age

GDP per PET, after the abrupt fall experienced during 2020, began a vigorous recovery which, following the revision carried out by the INE, shows even greater dynamism than that detected in previous observatories. However, the growth of this variable was interrupted in the fourth quarter of 2022. Since then, GDP per PET has remained around half a point below the value reached in the last quarter before the pandemic, which has meant that the gap with respect to its trend was still -2.4 pp in 2Q2023. Closing this gap over the next four quarters would require quarter-on-quarter GDP per PET growth rates that have not been seen since the second quarter of 2022, something that is expected to be difficult to achieve in the current context of a marked slowdown in the pace of economic activity.

The labour market: unemployment and vacancies

The indicator of labour market tightness in Spain, defined as vacancies among unemployment, has risen by 47% since 2019Q4, and this has happened in a context where, as we have already seen, wage margins have made a positive contribution to GDP growth.

The observed sharp fall in the growth rate of GDP per PET is mainly explained by the fall in the growth rate in the number of hours worked per PET, while productivity per hour grew by 1.11 QoQ3QoQ year-on-year in 2Q2023.

The evolution of the series in the first two quarters of 2023 reflects some fall in both the wage share and the unemployment rate, which is consistent with average wage per employee growth being lower than GDP growth.

Analysis of private investment

Private investment per PET has fluctuated around a constant, standing at a value about 3 percent below the pre-pandemic level, and showing stagnation over the last three years.

Since positive year-on-year growth rates have been observed in Spain following the revision of the Quarterly National Accounts, it has been supply shocks that have significantly boosted investment.

The behaviour of price margins, but also of wage margins, has played an important role in maintaining the growth rates of investment per PET. These components, together with TFP, have had the greatest weight on the positive side of supply shocks. By contrast, labour and capital taxation and residential investment shocks have generally detracted from the strength of investment growth. The information for 2Q2023 points, however, to a reversal in the contribution of these factors.

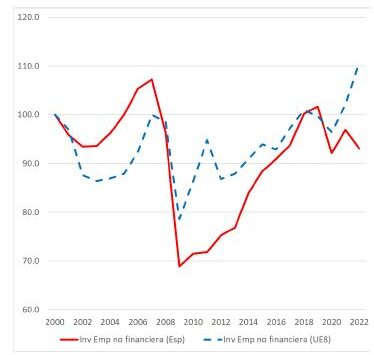

Spanish investment in the international context

The business investment rate is more volatile and persistent in Spain than in the EU8, reflecting a sharp fall at the beginning of the financial crisis, and a recovery in the EU8.

The subsequent investment rate has remained incomplete, with the result that the investment rate in 2022 was 7 per cent below that of the year 2000.

In 2019, the public investment rate in Spain was 42 per cent lower than in 2000. Since then, the public investment rate has increased by 15 per cent, although it is still 26 per cent below the rate observed in 2000. In contrast, the public investment rate in the EU8 has been much more stable over the last 22 years.