José E. Boscá, Rafael Doménech, Javier Ferri y Camilo Ulloa present the explanatory factors of the business cycle one year after the Grand Confinement in the ECO Report 2021.

This new version of the Business Cycle Observatory 2021 updates the study of the determinants of the business cycle in Spain with the information available up to the second quarter of 2021, including the important revision of GDP and its components carried out by INE. To do so, the researchers use a shock decomposition based on the EREMS macroeconomic model (see Boscá et al. 2020a) estimated with data up to the fourth quarter of 2020. In this way, it is possible to to analyse, characterise and make a preliminary assessment of the factors that have contributed to the sharp swings in macroeconomic variables during the COVID-19 crisis.

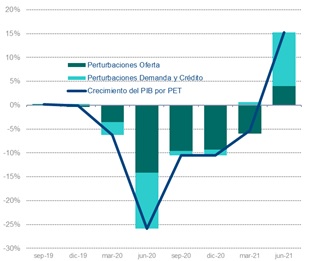

This model allows decomposing the growth rates of GDP and the main economic variables according to the contribution of the different shocks identified by the model. In particular, the model incorporates a banking sector that allows the estimation of different types of financial shocks, as well as fiscal (on both the expenditure and revenue sides), external, competition and other macroeconomic shocks.

Macroeconomic aggregates

In particular, the OCE 2021 Report identifies the origin of the disturbances and the intensity and persistence with which they are affecting three macroeconomic aggregates: GDP per working-age population, inflation, and real wage growth. This type of analysis provides valuable information for policy action, as the optimal policy response cannot be independent of the nature of shocks affecting relevant issues.

Investor and consumer expectations

In the previous observatory (Boscá, et al., 2021), researchers noted that supply factors had been gaining weight in explaining the business cycle as the year 2020 progressed. However, aggregate demand is dependent on shocks that affect investors' and consumers' expectations, that may have been influenced by the announcement of the arrival of EU funding through the Next Generation EU (NGEU). This observatory makes it possible to quantify the effect of these expectations on GDP.

Disturbances

The focus of the ECO Report 2021 is on in disturbances affecting the second quarter of 2021 as, when variables are measured in terms of year-on-year growth rates, they capture the effect on the sum of quarter-on-quarter growth rates since the Grand Confinement.

Quarterly National Accounts

This Observatory incorporates the major review of the Quarterly National Accounts for the second quarter carried out by INE.. This revision will undoubtedly have had an impact on the estimation of the shocks that characterise the behaviour of the GDP business cycle. In addition, as usual, we will devote the last section of the Observatory to two aspects that have been attracting the attention of macroeconomists in recent months, such as the observed behaviour of price inflation and real wage growth, and their relationship with the margins in goods and labour markets.