The Spanish economy facing the challenge of inflation

The Economic Cycle Observatoryinitiative of BBVA Research, Fedea and the Rafael del Pino Foundationupdates the study of the determinants of the business cycle in Spain with the information available up to the end of the year. second quarter 2022, including the latest revision of GDP and its components carried out by INE. To do so, it uses a shock decomposition from the macroeconomic model EREMS (see Boscá et al. 2020a).

This Observatory assesses the factors explaining the behaviour of the Spanish economy between the third quarter of 2020 and the second quarter of 2022, and estimates the structural shocks behind the growth of GDP per working-age person (WAP), the GDP deflator and real wages.

GDP growth per person of working age

GDP per PET, although it has been growing during the last three quarters at year-on-year rates above 61 QoQ, has not yet recovered either its pre-pandemic level (in 2Q2022 it is still 3.31 QoQ below its level in 4Q2019) or its trend level.

Supply shocks would explain the entire 5+ pp growth observed between the third quarter of 2021 and the second quarter of 2022.

Among the supply shocks, the main drivers of growth in the last year (3Q2021 to 2Q2022) are TFP growth (2.8 pp), wage margins (2.3 pp) and price margins (1 pp).

Demand and credit shocks have become less prominent over the course of 2022, contributing almost nothing to growth in the last quarter.

The labour market: unemployment and vacancies

Since the third quarter of 2020, the unemployment rate has been steadily declining at a pace of slightly more than 6 tenths of a percentage point per quarter to reach a rate of 12.51 QoQ in 2Q2022.

The vacancy rate has grown strongly during the second part of 2020, the whole of 2021 and the first two quarters of 2022, with the last quarter of the sample well above pre-pandemic levels (0.60% in 2Q22 vs. 0.47% in 4Q2019).

The ratio of vacancies to unemployment has grown during 2022, putting considerable strain on the labour market, compared to the pre-pandemic situation.

The evolution of productivity seems to have changed from the counter-cyclical behaviour that characterised the Spanish economy to a situation more in line with that of neighbouring economies, where productivity is pro-cyclical.

In 2Q2022 the share of wages in aggregate income stood at 53.31GDP3Q, still 1.5pp above its level at the end of 2019 and almost 1pp above the average since 1995.

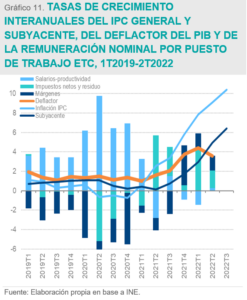

Inflation analysis: the GDP deflator and real wages

Up to 2Q2022 the increase in the year-on-year rate of headline inflation (9.11 QoQ in 2Q2022) is mainly a problem of imported inflation. The increase in the GDP deflator, i.e. for domestically produced goods and services, stands at 3.61GDP3Q.

Keeping the growth rates of the deflator, gross operating surpluses and mixed incomes and labour productivity-adjusted wages around 2% is crucial to avoid generating a price, wage and margin spiral through second round effects.

In 2Q2022 it is demand factors that are responsible for the notable rise in the year-on-year inflation rate of the GDP deflator, while supply factors contribute to its moderation.

In 2Q2022 the The annual growth rate of wages per FTE worker was 2 pp below the average. The fall is almost exclusively due to shocks to price and wage margins..

The Spanish economy in the international context

The comparison of the Growth and Prosperity in Spain and the EU8, shows unfavourable results. for Spain: there have been insufficient relative improvements in the level of prosperity, the unemployment rate, productivity and compensation per employee.