The Economic Cycle Observatoryinitiative of BBVA Research, Fedea and the Rafael del Pino Foundation have jointly launched the eleventh edition of the Observatory on the Economic Cycle in Spain, entitled "Economic Cycle, Employment and Productivity in 2023". This Observatory analyses and quantifies the influence of a wide range of structural factors that determine economic cycles with the help of a model designed by researchers from the three institutions involved.

In this edition of the Cycle Observatory the study of the determinants of the economic cycle in Spain is addressed with complete information up to the end of the year. fourth quarter 2023.

Business cycle, employment and productivity in 2023

From the fourth quarter of 2019 The increase in the foreign labour force in Spain up to the last quarter of 2023 was 569,000 people, which is accounts for 71.2% of total variation. As for the employmentalthough its performance in terms of social security enrolment during 2023 has been positive.In the case of workers with a fixed-term contract, uncertainty remains as to the actual use of the work of those workers with a fixed-term contract.. In this observatory we focus on the structural factors that explain the behaviour of full-time equivalent (FTE) employment.. The relationship between GDP and FTE employment will allow us to studying productivity performance and identify the main factors that are holding back their growth.

GDP growth per person of working age

The sharp drop in production in 2020 has slightly reduced trend GDP growth per working-age person since 1990, estimated at around 11GDP3T per year..

GDP per PET stopped its recovery in the second quarter of 2022 and, since then, has shown a flat profile that distances it from the historical potential growth of our economy. At the end of 2023, GDP per PET was 0.6 percentage points below the value reached in the last quarter before the pandemic, putting it at 0.5 percentage points lower than in the last quarter before the pandemic. the gap with respect to trend by -3.2 pp in 4Q2023. It confirms the pattern already detected in previous observatories of sharp slowdown in economic growth in terms of GDP per working-age person. Specifically, in 4Q2024 the year-on-year GDP growth rate was 1.1 pp below the average trend growth rate.

The labour market: unemployment and vacancies

Wage margin shocks, which had contributed very positively to GDP growth per PET over 2022, have shifted to a more positive contribution to GDP growth per PET over 2022. slightly negative contribution in 2023. In the coming quarters, attention will need to be paid to the evolution of the labour market tightness variable and how this feeds through to wage margins.

During the Covid crisis, the relationship between vacancy rates and unemployment did not move away from the initial Beveridge curve, unlike in the United States, where the processes of re-hiring, job exits, and relocation of workers shifted sharply to the right of the Beveridge curve (Barlevy, Faberman, Hobijn and Sahin, 2023). In 4Q2023 the vacancy/unemployment ratio remains on the Beveridge curve of the pre-Great Recession expansionary cycle. The shift to the upper left along the range, initiated after the pandemic confinement, is a reflection of the increased tensions that are affecting the labour market.

The year 2023 has been particularly negative in terms of productivity growth. According to the information for 4Q2023, the annual growth rate of GDP per PET has been dragged down by 0.8 pp by the poor performance of GDP per hour worked.while hours per PET have kept up with GDP growth. A more detailed analysis of the factors underlying hours and productivity will be made in section 4 of this observatory.

Analysis of recent employment and productivity developments

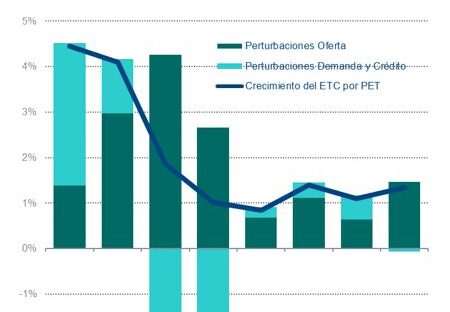

Contrary to what was detected for GDP per PET, the growth rate of FTE employment is above its historical trend and relatively stable in the five quarters to 4Q2023.. Aggregate supply shocks have made a positive contribution throughout the period under review, and have been the main driver of FTE employment since 2Q2022. In fact, the annual growth rate of this variable during 2023 has been almost entirely explained by supply shocks, while demand shocks have played a neutral role.

GDP per PET, productivity, hours and employment of the Spanish economy in the European context

The fundamental conclusions drawn from the analysis are unfavourable for the Spanish economy. Not only has there been no convergence between the beginning and the end of the period considered between its GDP/PET and that of its European benchmark partners, but the deterioration of almost six percentage points that occurred between the five-year period before and after the Great Recession has barely recovered by one point in the decade that followed. In other words, Spain's GDP per PET was 23.71 Tbp3T lower than that of the EU8 in the three-year period 2020-2022, compared to 18.91 Tbp3T for the average of the five-year period 2004-2008..

The unfavourable trajectory of the Spanish economy cannot be attributed to a particularly dynamic performance of the benchmark countries: between 2004 and 2022 the increase in GDP per PET of the (weighted) average of the eight countries considered was a modest 11 Q3GDP compared to a still lower 0.91 Q3GDP for the Spanish economy. The key to understanding this adverse and persistent differential lies in a critical variable for economic growth in the medium and long term: labour productivity.